Back to Courses

Business Courses - Page 41

Showing results 401-410 of 2058

Create a Simple Gantt Chart using Google Sheets

By the end of this project, you will be able to create a simple Gantt Chart using Google Sheets. You will have a better understanding of how to use this tool to help track and present project schedules.

Note: This course works best for learners who are based in the North America region. We’re currently working on providing the same experience in other regions.

Multistate Taxation

This course will examine state and local tax laws prevalent in the United States today. The course will consider the historical progression of state and local taxation, the power of states to tax (and the limitations on that power), and planning strategies for minimizing the impact of state and local taxation. Discussions will focus on income taxes, sales taxes, and property taxes.

If you enjoy this course, consider enrolling in our online graduate Accounting program. The University of Illinois at Urbana-Champaign, consistently ranked as one of the nation's top three accounting programs, now offers a master’s in accounting at a very affordable tuition rate and is completely online. The iMSA is a full Master of Accountancy program and students graduate with an MS that is highly recognized. Try an open course or two, then apply for admission into the credit-bearing version as you may be eligible to take credit-bearing courses during the application process. If you are missing any prerequisites for the full degree, you can complete Coursera courses to demonstrate readiness and strengthen your application for the iMSA. For more information on this exciting iMSA online program, refer to this link: https://www.coursera.org/degrees/imsa

Advanced Valuation and Strategy - M&A, Private Equity, and Venture Capital

Hi and welcome to this course!

Would you like to learn about the latest valuation methods that may help you to make better business decisions? Then 'Advanced Valuation and Strategy – M&A, Private Equity, and Venture Capital' by Erasmus University Rotterdam is the right course for you! This course is helpful for executives that need to value complete strategies and for all students interested in corporate finance and strategy. We present the latest tools and show you how to apply them!

We will revolutionize your way of decision making, by extending static techniques from corporate finance with dynamic methods to quantify strategic thinking. Traditionally, we assess the attractiveness of an investment as a mature business, where future cash flows mainly result from past decisions. But, in an ever-changing world, strategic decisions determine the firm’s long-term success and market value. Yet managers often have to consider these long-term implications using intuition and experience alone, with little guidance from structured, quantitative analysis.

Our treatment goes far beyond the use of standard valuation analysis. We introduce the expanded NPV, which brings together DCF, real options, and game theory. Thinking in terms of options, games, and adaptive strategies may help managers address strategic questions such as: How do you value a leveraged buyout? How can you value a high-tech venture with negative cash flows? When should you invest in new ventures in stages? How can you incorporate rival bidders in the analysis?

The tools we provide can improve your decisions in business and in daily life.

* Who is this class for?

We hope that our course appeals to (graduate) students in finance, economics, and business, as well as to high-ranking professionals and a general audience. This course is particularly interesting for venture capitalists, private equity investors, investment bankers, CEOs, CFOs, and those who aspire these affiliations. We offer this MOOC at 3 levels:

1.Executive Summary:

This 1-week module provides critical insights into the principles of corporate valuation and strategy. This is accessible for time-constrained executives and the general audience without any prior knowledge.

2. Student Level:

This level involves an understanding of the technical details. This level requires basic knowledge of concepts in corporate finance, e.g., the time value of money, financial statement analysis, capital structure, and the relation between risk and returns. Learners of this level can skip week 1.

3. Honors Level (honors certificate):

This level is challenging, engaging, and compelling to an intellectually rigorous student.

Use WordPress to Create a Blog for your Business

By the end of this project, you will create a blog site with a home page and initial blog post using a free content management system, WordPress. You will be able to create a business blog with the look and feel of a website complete with options for e-commerce plugins. You’ll have a virtual space to showcase your business with customers who want to stay connected.

Entrepreneurship II: Preparing for Launch

This course builds on previous concepts and outlines strategies and tactics for forming, financing, and launching a new venture. Topics to be addressed will include building the new venture’s initial management team, identifying and reaching out to early customers, developing financial plans, raising startup and initial growth financing, and preparing for and managing rapid growth.

You will be able to:

- Develop an understanding of what is required in a new venture

- Create a plan to identify and approach your first customers

- Build financial projections for the new venture

- Understand how to raise equity capital for the new venture

- Monitor the health and scalability of a new venture

This course is part of Gies College of Business’ suite of online programs, including the iMBA and iMSM. Learn more about admission into these programs and explore how your Coursera work can be leveraged if accepted into a degree program at https://degrees.giesbusiness.illinois.edu/idegrees/.

Management Fundamentals

People are the most valuable asset of any business, but they are also the most unpredictable, and the most difficult asset to manage. And although managing people well is critical to the health of any organization, most managers don't get the training they need to make good management decisions. Now, award-winning authors and renowned management Professors Mike Useem and Peter Cappelli of the Wharton School have designed this course to introduce you to the key elements of managing people. Based on their popular course at Wharton, this course will teach you how to motivate individual performance and design reward systems, how to design jobs and organize work for high performance, how to make good and timely management decisions, and how to design and change your organization’s architecture. By the end of this course, you'll have developed the skills you need to start motivating, organizing, and rewarding people in your organization so that you can thrive as a business and as a social organization.

Business English: Final Project

A common necessity among business professionals who are new to an international work environment is the ability to create a plan of action to launch a new product. In this task, one has to communicate with many different departments within a company including finance and marketing. In this capstone project, you will create a plan of action to launch a new product. This plan will include:

· A project status report

· A copy of the marketing campaign

· A basic budget analysis for the project

· A short presentation for upper management with details on the project’s status

This project will give you the opportunity to apply your English skills learned in the courses to develop a useful document for your current job or a document that you could use as an example to demonstrate your new abilities and skills.

Linear Regression for Business Statistics

Regression Analysis is perhaps the single most important Business Statistics tool used in the industry. Regression is the engine behind a multitude of data analytics applications used for many forms of forecasting and prediction.

This is the fourth course in the specialization, "Business Statistics and Analysis". The course introduces you to the very important tool known as Linear Regression. You will learn to apply various procedures such as dummy variable regressions, transforming variables, and interaction effects. All these are introduced and explained using easy to understand examples in Microsoft Excel.

The focus of the course is on understanding and application, rather than detailed mathematical derivations.

Note: This course uses the ‘Data Analysis’ tool box which is standard with the Windows version of Microsoft Excel. It is also standard with the 2016 or later Mac version of Excel. However, it is not standard with earlier versions of Excel for Mac.

WEEK 1

Module 1: Regression Analysis: An Introduction

In this module you will get introduced to the Linear Regression Model. We will build a regression model and estimate it using Excel. We will use the estimated model to infer relationships between various variables and use the model to make predictions. The module also introduces the notion of errors, residuals and R-square in a regression model.

Topics covered include:

• Introducing the Linear Regression

• Building a Regression Model and estimating it using Excel

• Making inferences using the estimated model

• Using the Regression model to make predictions

• Errors, Residuals and R-square

WEEK 2

Module 2: Regression Analysis: Hypothesis Testing and Goodness of Fit

This module presents different hypothesis tests you could do using the Regression output. These tests are an important part of inference and the module introduces them using Excel based examples. The p-values are introduced along with goodness of fit measures R-square and the adjusted R-square. Towards the end of module we introduce the ‘Dummy variable regression’ which is used to incorporate categorical variables in a regression.

Topics covered include:

• Hypothesis testing in a Linear Regression

• ‘Goodness of Fit’ measures (R-square, adjusted R-square)

• Dummy variable Regression (using Categorical variables in a Regression)

WEEK 3

Module 3: Regression Analysis: Dummy Variables, Multicollinearity

This module continues with the application of Dummy variable Regression. You get to understand the interpretation of Regression output in the presence of categorical variables. Examples are worked out to re-inforce various concepts introduced. The module also explains what is Multicollinearity and how to deal with it.

Topics covered include:

• Dummy variable Regression (using Categorical variables in a Regression)

• Interpretation of coefficients and p-values in the presence of Dummy variables

• Multicollinearity in Regression Models

WEEK 4

Module 4: Regression Analysis: Various Extensions

The module extends your understanding of the Linear Regression, introducing techniques such as mean-centering of variables and building confidence bounds for predictions using the Regression model. A powerful regression extension known as ‘Interaction variables’ is introduced and explained using examples. We also study the transformation of variables in a regression and in that context introduce the log-log and the semi-log regression models.

Topics covered include:

• Mean centering of variables in a Regression model

• Building confidence bounds for predictions using a Regression model

• Interaction effects in a Regression

• Transformation of variables

• The log-log and semi-log regression models

Sustainable Vikings: Sustainability & Corporate Social Responsibility in Scandinavia

This course gives you immediate access to the world leading sustainability and corporate social responsibility (CSR) practices. Scandinavian firms dominate the major sustainability and CSR performance indicators including the Dow Jones Sustainability Index (DJSI). In this course we explore the concepts of sustainability and CSR and focus attention on how Scandinavian firms, like Novo Nordisk, have achieved superior sustainability and CSR performances. We consider what lessons can be drawn by managers and firms irrespective of where they may be located in the world.

Through this course, participants will:

• Gain appreciation of the concepts of sustainability and corporate social responsibility (CSR) and be able to situate these concepts within the broader debates about the role of business in society

• Understand the sustainability and CSR approaches by leading Scandinavian companies

• Describe how partnerships between companies, NGOs, and government are fundamental to the sustainability and CSR by Scandinavian companies

• Be able to describe the characterization of the “Scandinavian management” and the role Scandinavian management plays in sustainability and CSR approaches by Scandinavian firms

• Become familiarized with concept of “Scandinavian Cooperative Advantage” and understand how it challenges the dominant view of strategic management.

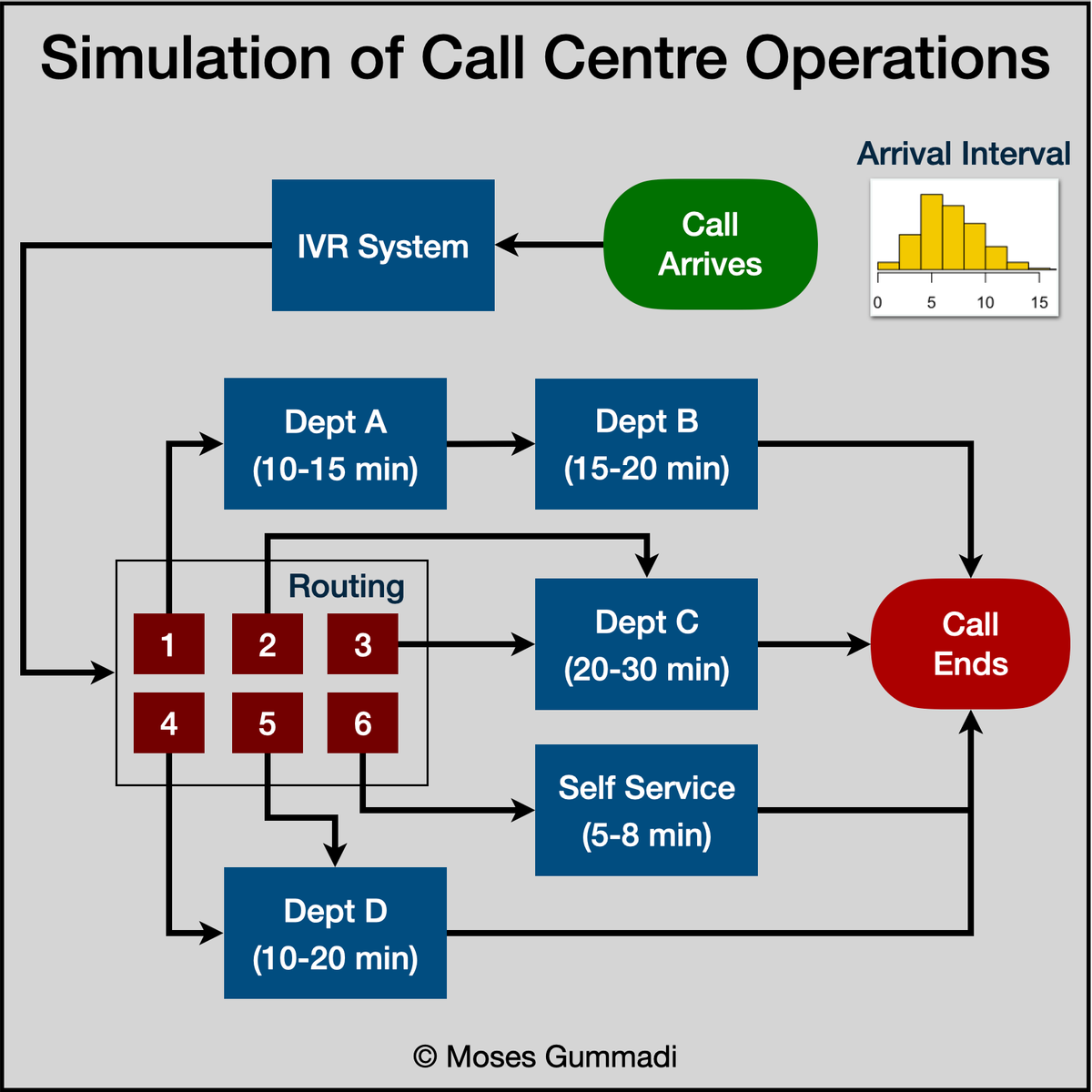

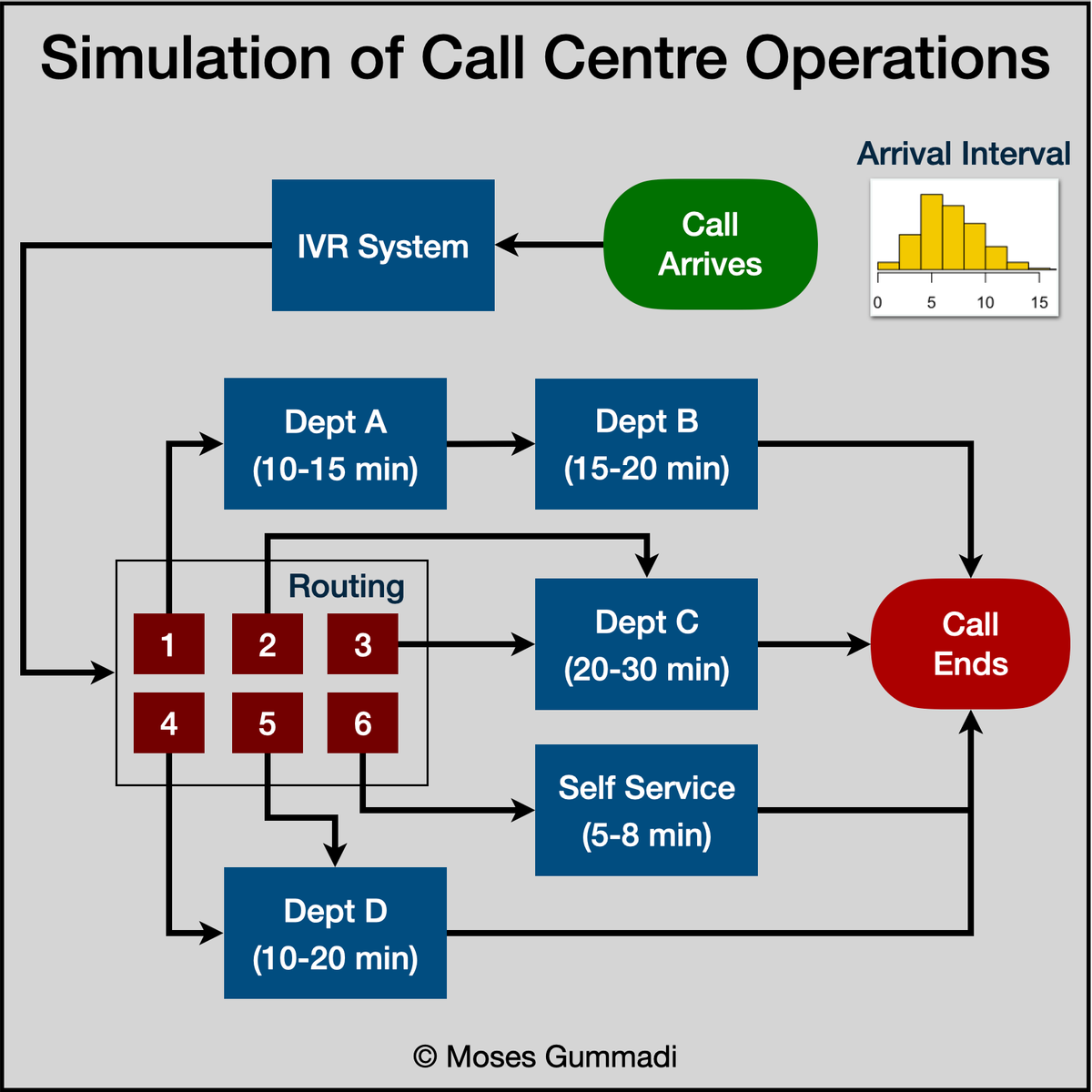

Simulation of Call Centre Operations Using R Simmer

Introduction To Call Centre Simulation Process

Create Statistical Variables Required For Simulation

Define Trajectories for Call Centre Departments

Define Teams, Resources & Arrivals of Calls

Run Call Centre Simulation & Store Results

Plot Charts & Interpret Simulation Results

Popular Internships and Jobs by Categories

Browse

© 2024 BoostGrad | All rights reserved