Back to Courses

Business Essentials Courses - Page 14

Showing results 131-140 of 645

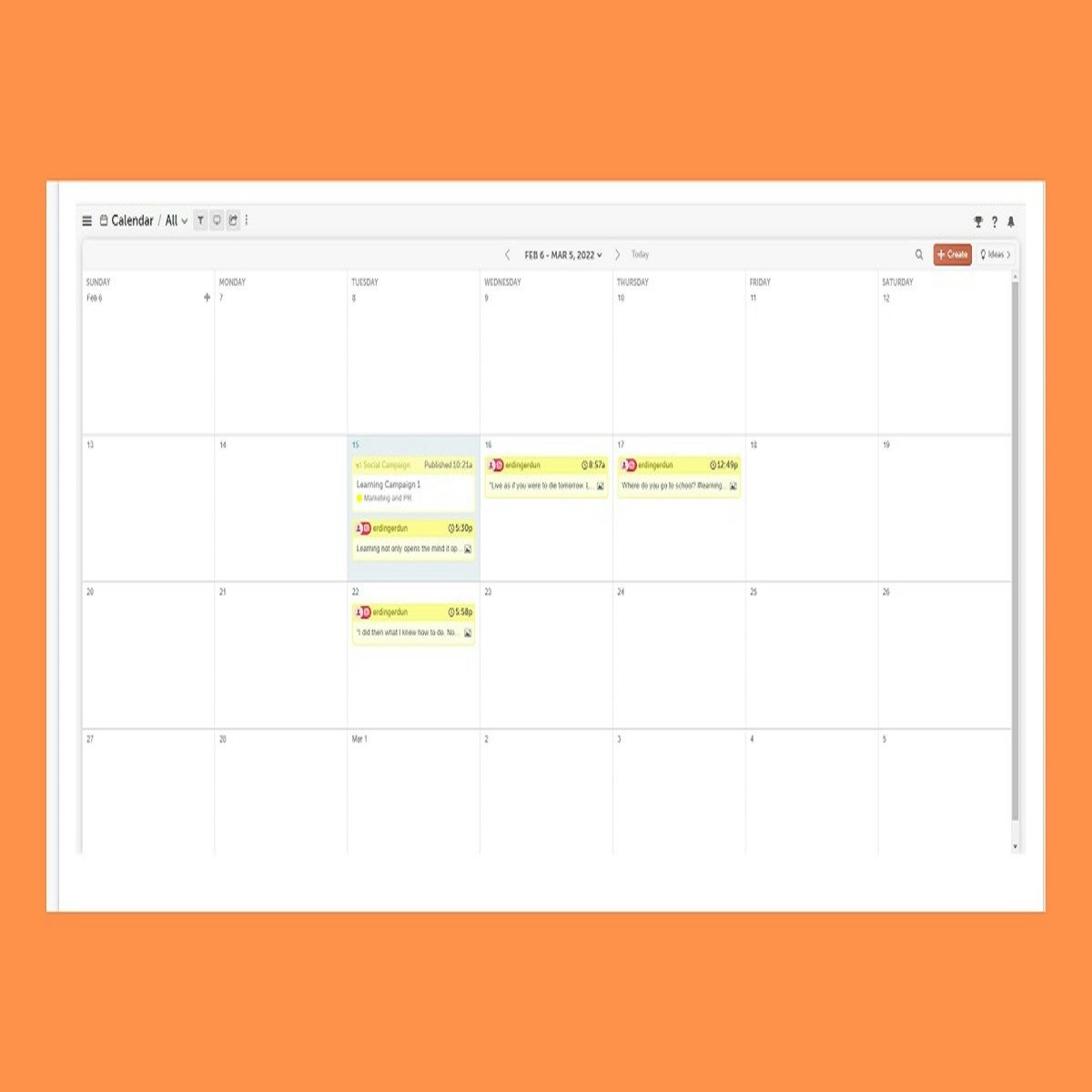

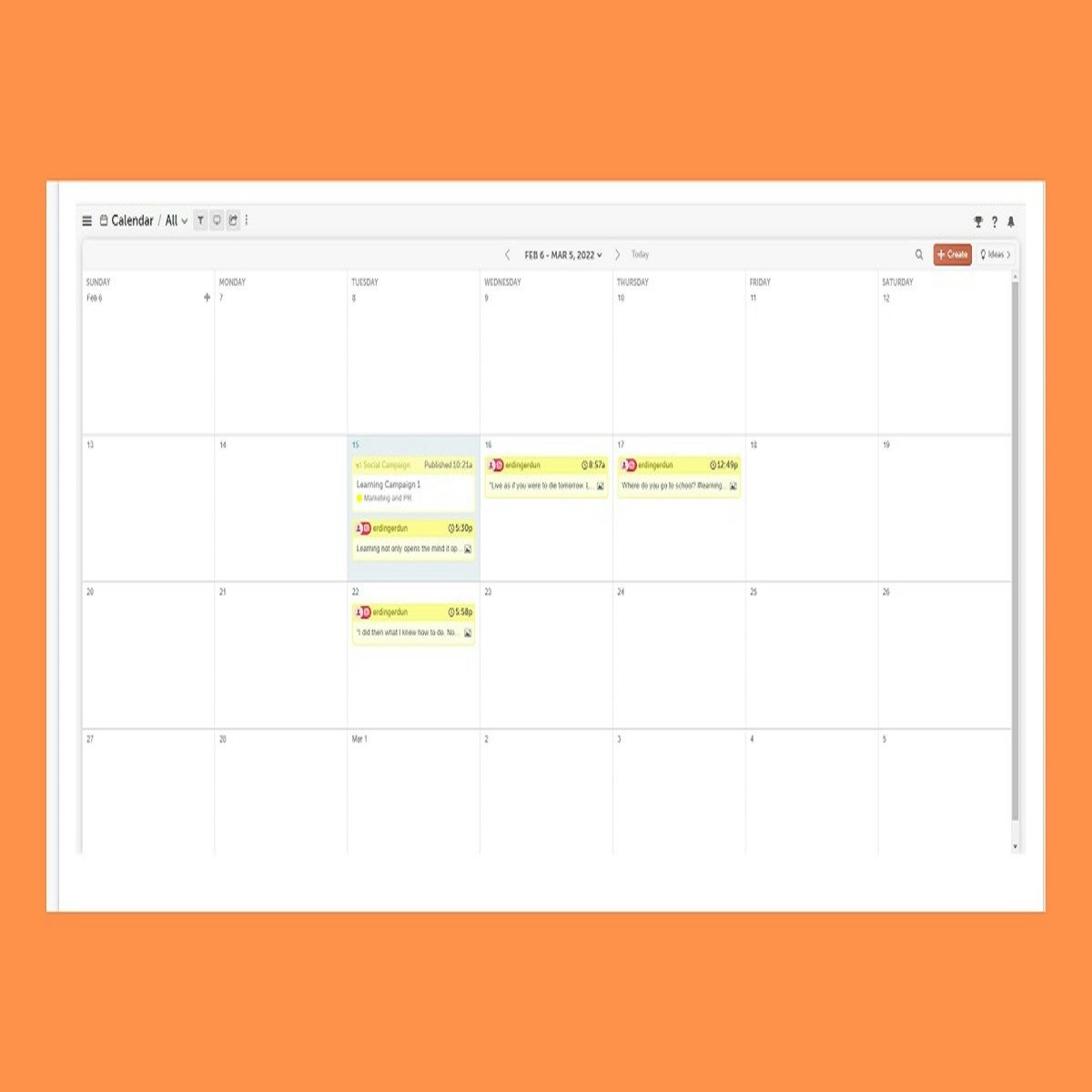

Create a Free Marketing Calendar with CoSchedule

In the business world today you need tools that can make your job easier and let’s be real, you need tools that work for you to complete your tasks faster. You will see that you can add all of your projects to your marketing calendar from various apps that your organization uses with CoSchedule.You will explore the work you can do with emails, events, and website content with iMessage, Slack, and Gmail within CoSchedule. In this project, you will see how you can use CoSchedule to create a marketing calendar that focuses on a social campaign to keep your projects organized and save you time.

Necessary Condition Analysis (NCA)

Welcome to Necessary Condition Analysis (NCA).

NCA analyzes data using necessity logic. A necessary condition implies that if the condition is not in place, there will be guaranteed failure of the outcome. The opposite however is not true; if the condition is in place, success of the outcome is not guaranteed.

Examples of necessary conditions are a student’s GMAT score for admission to a PhD program; a student will not be admitted to a PhD program when his GMAT score is too low. Intelligence for creativity, as creativity will not exist without intelligence, and management commitment for organizational change, as organizational change will not occur without management commitment.

NCA can be used with existing or new data sets and can give novel insights for theory and practice. You can apply NCA as a stand-alone approach, or as part of a multi-method approach complementing multiple linear regression (MLR), structural equation modelling (SEM) or Qualitative Comparative Analysis (QCA).

This course explains the basic elements of NCA and uses illustrative examples on how to perform NCA with R software. Topics include (i) Setting up an NCA study (ii) Run NCA and (iii) Present the results of NCA.

We hope you enjoy the course!

Communication in the 21st Century Workplace

The workplace is more diverse than ever before. As the world population grows and our connectivity increases, it is common to work alongside colleagues from different generations, life experiences, cultures, genders, orientations, and religions. The increased diversity coupled with the shift toward remote and hybrid work environments means it's more critical than ever to develop appropriate communication strategies and practices. This course will teach you to identify and adapt your own communication style to not only increase team productivity, but also build bridges with colleagues from all backgrounds.

By the end of this course, you will be able to:

1.Identify your own communication style

2. Describe methods to increase effective communication

3. Discuss how changing demographics affect workplace communication

4. Differentiate between the five working generations and their communication preferences

5. Identify the communication benefits of different work environments, such as in-person, virtual, or hybrid

6. Discuss effective techniques for communicating with a diverse workforce

7. Implement a flexing communication strategy to better communicate with one’s workplace team

Financial Analysis of Scenarios and Decisions

This course focuses on adopting and implementing a financially analytic mindset when engaged in organizational decision-making and scenario analysis.

The course begins with an overview of the "internal" perspective of the organization, in which you will learn fundamental concepts, including the importance of how cost information is organized for different decision scenarios. You will then learn about scenario analysis, including cost-volume-profit analysis and other fundamental concepts that help facilitate financial organizational decision-making.

Next, you will learn about planning and budgeting, a key function that allows organizations to identify and allocate resources necessary to achieve organizational goals. You will then learn how to assess actual performance against these budgets using variance analysis.

Finally, you will learn about the organization’s performance measurement, evaluation, and compensation system. Specifically, you will learn about the advantages and disadvantages of common financial performance measures and understand how an organization uses non-financial performance measures within its strategic performance measurement system to complement the financial perspective.

ESG Data & Accountability

In this course, we’ll introduce students with basic knowledge of traditional financial products to data-driven resources they can use to complement their fundamental analysis. We’ll also highlight certain deceptive marketing practices that can paint a rosier picture of addressing ESG-related concerns than may actually be the case.

Moreover, many corporations appear to be growing increasingly aware of the values of the millennial generation, who, according to some industry surveys, appear to account for the vast majority of those who cite ESG as a central goal in their investment plans.

We’ll dive more deeply into these topics, and through a series of video, webinar, and reading modules, among other objectives, you’ll learn to explain how Big Data and artificial intelligence may be used for actionable accountability, and describe inherent challenges in data analysis, as well as differentiate between different forms of deceptive business practices, including green washing, social washing, and pink washing, You’ll also be able to provide insights about how millennial, and younger, investors’ interests may be driving increased attention on ESG investing.

Multistate Taxation

This course will examine state and local tax laws prevalent in the United States today. The course will consider the historical progression of state and local taxation, the power of states to tax (and the limitations on that power), and planning strategies for minimizing the impact of state and local taxation. Discussions will focus on income taxes, sales taxes, and property taxes.

If you enjoy this course, consider enrolling in our online graduate Accounting program. The University of Illinois at Urbana-Champaign, consistently ranked as one of the nation's top three accounting programs, now offers a master’s in accounting at a very affordable tuition rate and is completely online. The iMSA is a full Master of Accountancy program and students graduate with an MS that is highly recognized. Try an open course or two, then apply for admission into the credit-bearing version as you may be eligible to take credit-bearing courses during the application process. If you are missing any prerequisites for the full degree, you can complete Coursera courses to demonstrate readiness and strengthen your application for the iMSA. For more information on this exciting iMSA online program, refer to this link: https://www.coursera.org/degrees/imsa

Use WordPress to Create a Blog for your Business

By the end of this project, you will create a blog site with a home page and initial blog post using a free content management system, WordPress. You will be able to create a business blog with the look and feel of a website complete with options for e-commerce plugins. You’ll have a virtual space to showcase your business with customers who want to stay connected.

Business English: Final Project

A common necessity among business professionals who are new to an international work environment is the ability to create a plan of action to launch a new product. In this task, one has to communicate with many different departments within a company including finance and marketing. In this capstone project, you will create a plan of action to launch a new product. This plan will include:

· A project status report

· A copy of the marketing campaign

· A basic budget analysis for the project

· A short presentation for upper management with details on the project’s status

This project will give you the opportunity to apply your English skills learned in the courses to develop a useful document for your current job or a document that you could use as an example to demonstrate your new abilities and skills.

Linear Regression for Business Statistics

Regression Analysis is perhaps the single most important Business Statistics tool used in the industry. Regression is the engine behind a multitude of data analytics applications used for many forms of forecasting and prediction.

This is the fourth course in the specialization, "Business Statistics and Analysis". The course introduces you to the very important tool known as Linear Regression. You will learn to apply various procedures such as dummy variable regressions, transforming variables, and interaction effects. All these are introduced and explained using easy to understand examples in Microsoft Excel.

The focus of the course is on understanding and application, rather than detailed mathematical derivations.

Note: This course uses the ‘Data Analysis’ tool box which is standard with the Windows version of Microsoft Excel. It is also standard with the 2016 or later Mac version of Excel. However, it is not standard with earlier versions of Excel for Mac.

WEEK 1

Module 1: Regression Analysis: An Introduction

In this module you will get introduced to the Linear Regression Model. We will build a regression model and estimate it using Excel. We will use the estimated model to infer relationships between various variables and use the model to make predictions. The module also introduces the notion of errors, residuals and R-square in a regression model.

Topics covered include:

• Introducing the Linear Regression

• Building a Regression Model and estimating it using Excel

• Making inferences using the estimated model

• Using the Regression model to make predictions

• Errors, Residuals and R-square

WEEK 2

Module 2: Regression Analysis: Hypothesis Testing and Goodness of Fit

This module presents different hypothesis tests you could do using the Regression output. These tests are an important part of inference and the module introduces them using Excel based examples. The p-values are introduced along with goodness of fit measures R-square and the adjusted R-square. Towards the end of module we introduce the ‘Dummy variable regression’ which is used to incorporate categorical variables in a regression.

Topics covered include:

• Hypothesis testing in a Linear Regression

• ‘Goodness of Fit’ measures (R-square, adjusted R-square)

• Dummy variable Regression (using Categorical variables in a Regression)

WEEK 3

Module 3: Regression Analysis: Dummy Variables, Multicollinearity

This module continues with the application of Dummy variable Regression. You get to understand the interpretation of Regression output in the presence of categorical variables. Examples are worked out to re-inforce various concepts introduced. The module also explains what is Multicollinearity and how to deal with it.

Topics covered include:

• Dummy variable Regression (using Categorical variables in a Regression)

• Interpretation of coefficients and p-values in the presence of Dummy variables

• Multicollinearity in Regression Models

WEEK 4

Module 4: Regression Analysis: Various Extensions

The module extends your understanding of the Linear Regression, introducing techniques such as mean-centering of variables and building confidence bounds for predictions using the Regression model. A powerful regression extension known as ‘Interaction variables’ is introduced and explained using examples. We also study the transformation of variables in a regression and in that context introduce the log-log and the semi-log regression models.

Topics covered include:

• Mean centering of variables in a Regression model

• Building confidence bounds for predictions using a Regression model

• Interaction effects in a Regression

• Transformation of variables

• The log-log and semi-log regression models

Taxation of Business Entities I: Corporations

This course provides an introduction to the U.S. federal income taxation of corporations and their shareholders. The course focuses on the relevant provisions of Subchapter C of the Internal Revenue Code, as well as related Treasury Regulations and judicial opinions, governing corporate formation, operations, distributions, and liquidation. Practical in-class study problems facilitate self-discovery of technical tax knowledge along with the development of a variety of professional skills and attitudes.

Popular Internships and Jobs by Categories

Find Jobs & Internships

Browse

© 2024 BoostGrad | All rights reserved