Back to Courses

Economics Courses - Page 8

Showing results 71-80 of 99

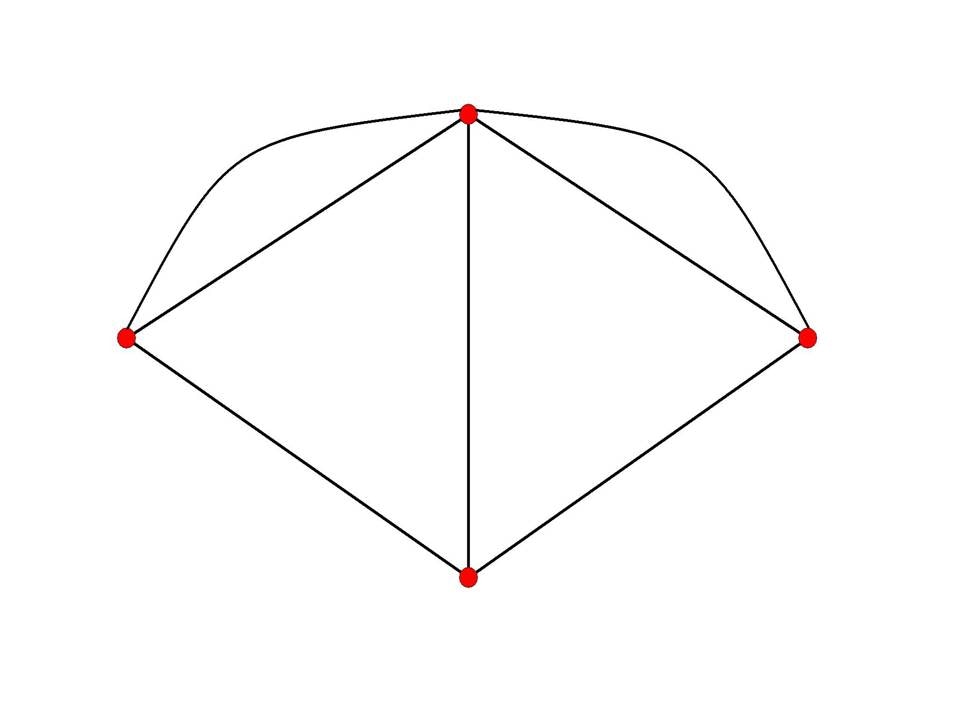

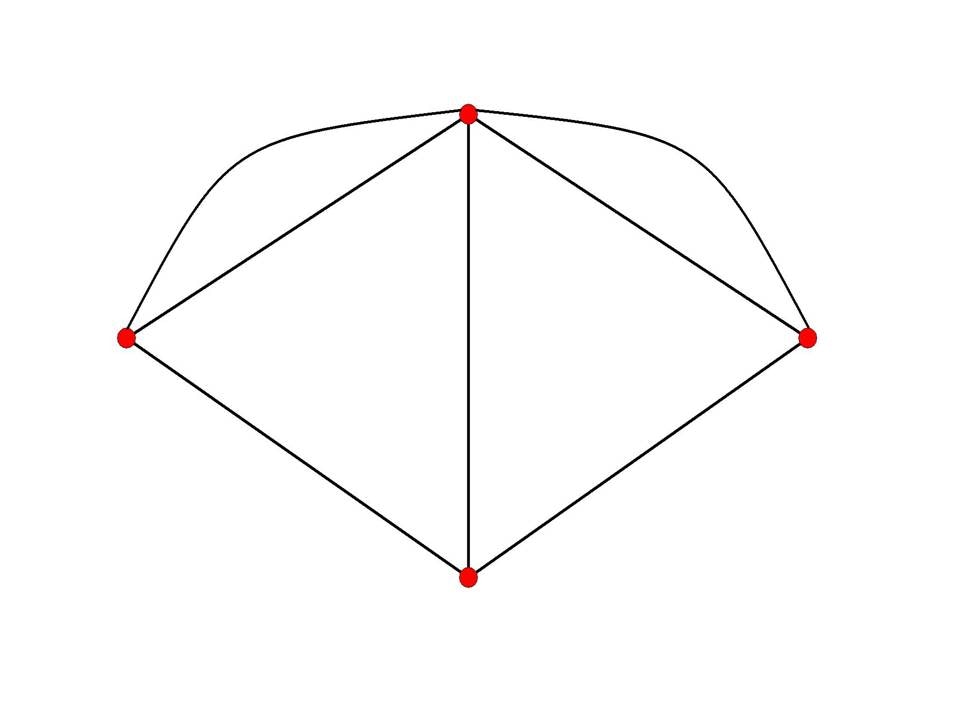

Social and Economic Networks: Models and Analysis

Learn how to model social and economic networks and their impact on human behavior. How do networks form, why do they exhibit certain patterns, and how does their structure impact diffusion, learning, and other behaviors? We will bring together models and techniques from economics, sociology, math, physics, statistics and computer science to answer these questions.

The course begins with some empirical background on social and economic networks, and an overview of concepts used to describe and measure networks. Next, we will cover a set of models of how networks form, including random network models as well as strategic formation models, and some hybrids. We will then discuss a series of models of how networks impact behavior, including contagion, diffusion, learning, and peer influences.

You can find a more detailed syllabus here: http://web.stanford.edu/~jacksonm/Networks-Online-Syllabus.pdf

You can find a short introductory videao here: http://web.stanford.edu/~jacksonm/Intro_Networks.mp4

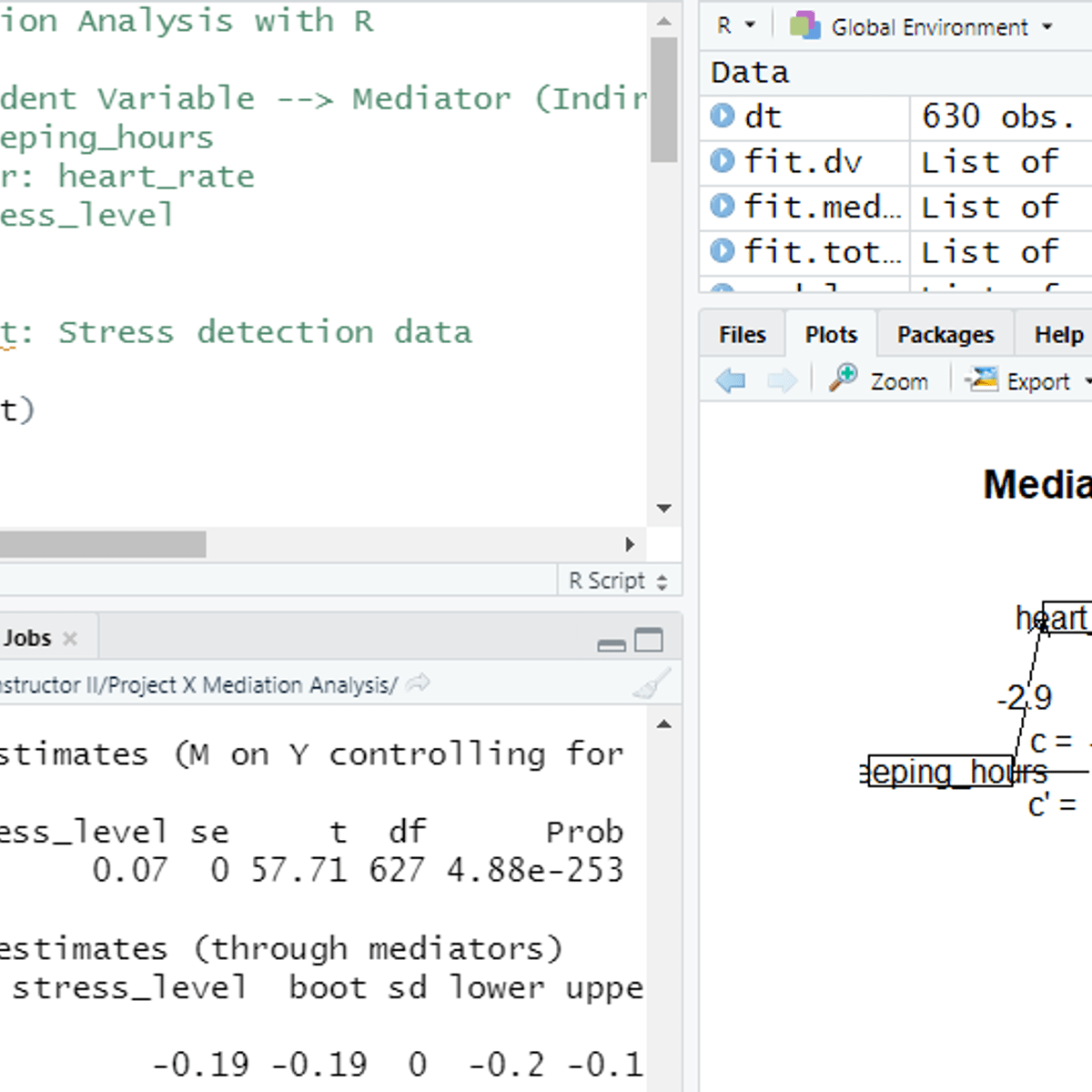

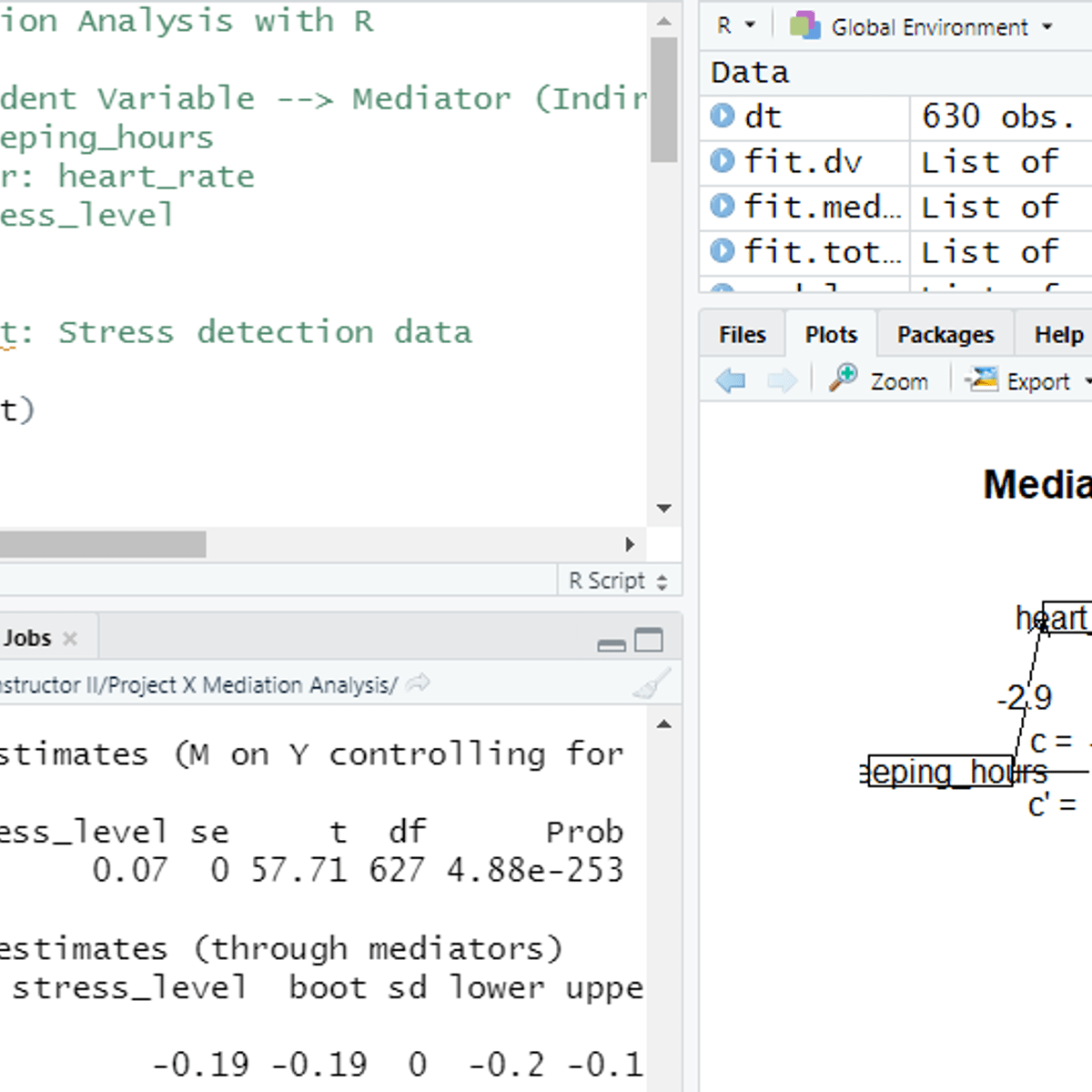

Mediation Analysis with R

In this project, you will learn to perform mediation analysis in RStudio. The project explains the theoretical concepts of mediation and illustrates the process with sample stress detection data. It covers the distinction between mediation and moderation process, explains the selection criteria for a suitable mediator. The project describes the mediation process with statistical models, diagnostic measures and conceptual diagram.

Understanding the Australian economy: An introduction to macroeconomic and financial policies

This four-week, four-module course explores selective aspects of the Australian economy, with emphasis on macroeconomic and financial policies. The course introduces participants to several key attributes of the Australian economy and discusses how they are influenced by both domestic and international forces. We will examine some of the key issues and dilemmas facing the Australian economy and how policymakers can deal with them using monetary and fiscal policies. There will also be a discussion on the still-fresh 2007-2010s global financial crisis, the lessons learned, and how policymakers deal with the aftermath. Discussions will be centered around sound economic theories and reasoning, and utilize actual data whenever applicable. Applications of the economic reasoning and theories to current, real-world issues pertaining to the Australian economy will also be provided. In addition to conventional lectures, the course also contains several interviews with relevant experts and practitioners. No prior knowledge or training in economics is required.

Design your own trading strategy – Culminating Project

In the culminating project, you will develop new trading strategies, evaluate them using the tools learned in the course, integrate them with the existing portfolio and also develop a plan to start a hedge fund.

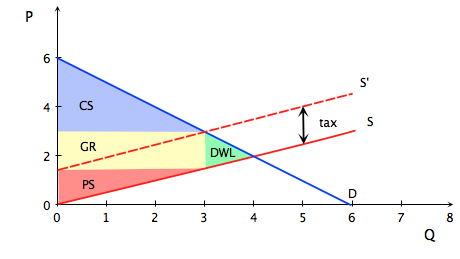

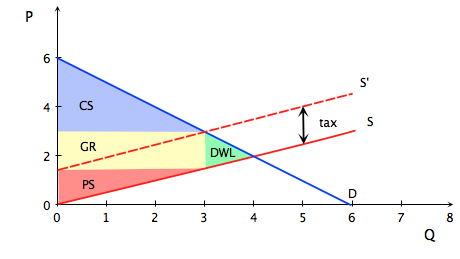

Microeconomics: The Power of Markets

We make economics decisions every day: what to buy, whether to work or play, what to study. We respond to markets all the time: prices influence our decisions, markets signal where to put effort, they direct firms to produce certain goods over others. Economics is all around us.

This course is an introduction to the microeconomic theory of markets: why we have them, how they work, what they accomplish. We will start with the concept of scarcity and how specialization according to comparative advantage helps us achieve more than we could alone. Next we model a marked using the tools of Supply and Demand and learn what well working markets accomplish and what their limit are. We end by exploring the impact of government intervention on perfect markets. Examples are taken from everyday life, from goods and services that we all purchase and use. We will apply the theory to current events and policy debates through weekly exercises. These will empower you to be an educated, critical thinker who can understand, analyze and evaluate market outcomes.

Economics and Policies of Climate Change

Being aware of the urgency and importance of climate change is not enough to tackle it effectively. To avoid the worst climate outcomes, decisive action has to be taken. But what realistic options do we have? Since our resources are limited, is it better to act now or wait until we have more advanced and less expensive technology? How big do our abatement efforts have to be?

This MOOC will help you understand how economists try to answer these questions and find the optimal course of action. Most important, it will give you the conceptual tools to draw your own conclusions.

In the first part of the MOOC, you will learn about the two main approaches used by economists to determine when and how much we should invest in the fight against climate change. The first method is the net-present-value approach. Here the social discount rate plays a central role in determining optimal policy, by showing how future benefits and costs can be compared and made comparable (‘present-valued’) with expenditures today. In the second approach you will learn how Integrated Assessment Models (IAMs) work. In particular, you will study in detail the strengths and weaknesses of one of the most popular IAMs, the DICE model, developed by Nobel laureate Professor Nordhaus. This model tries to figure out the optimal course of action by providing a simplified account of the science, the technology and the economics of the problem.

The second part of this MOOC then explores the different types of economic policies that decision-makers can adopt. You will be introduced to different methods used to control emissions, such as carbon taxes, regulations and standard-setting. You will also learn about the most developed emissions trading markets around the world and their effects on the economy.

This MOOC is for those who wish to understand the economics of climate change and use this understanding to form their own informed opinion about the policies on which we can rely to tackle it. It is not necessary to have specialized prior knowledge, apart from basic familiarity with economic concepts such as utility functions. We do suggest, however, taking the first MOOC of this specialization before starting this one in order to gain a simple but solid understanding of the physical and technological aspects of the problems.

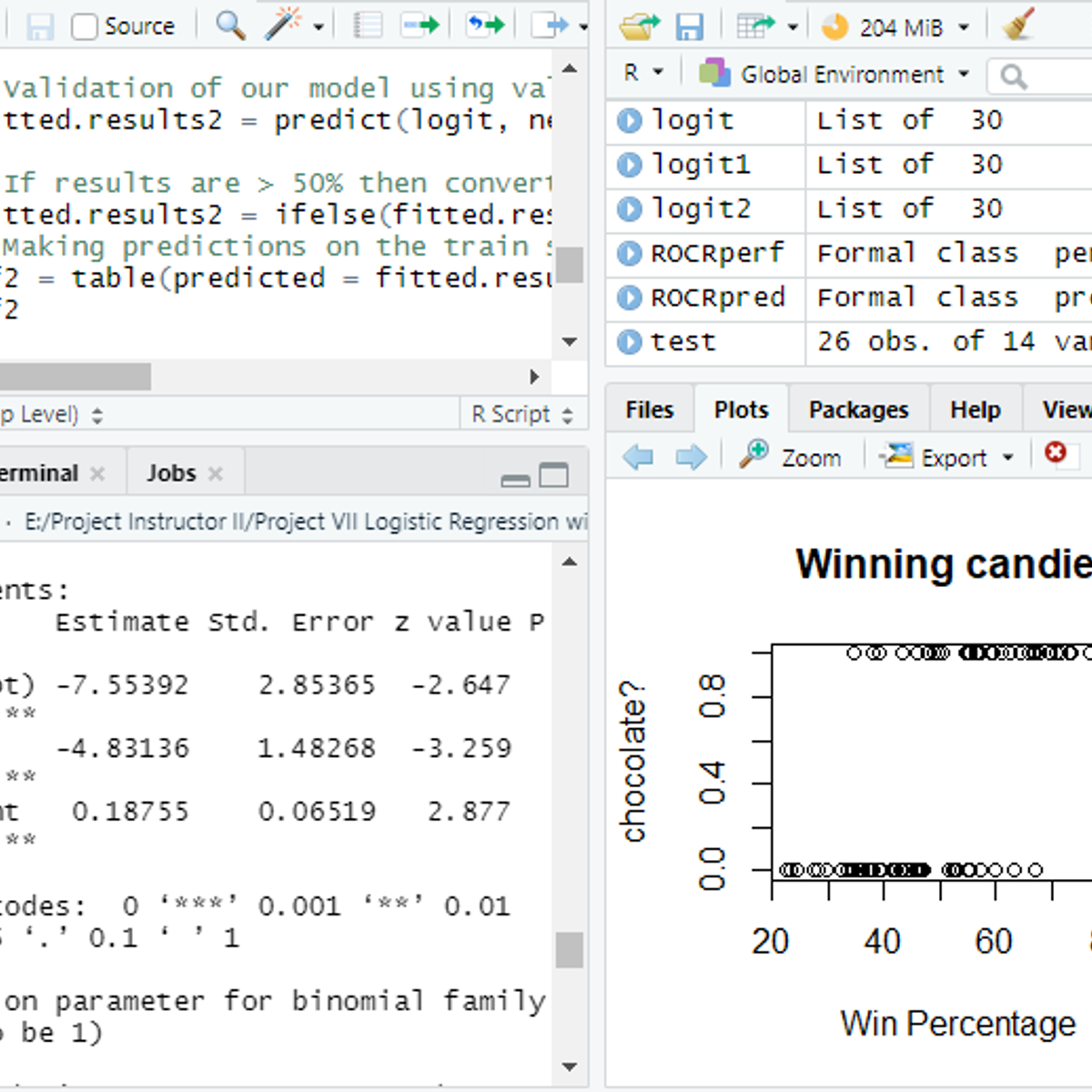

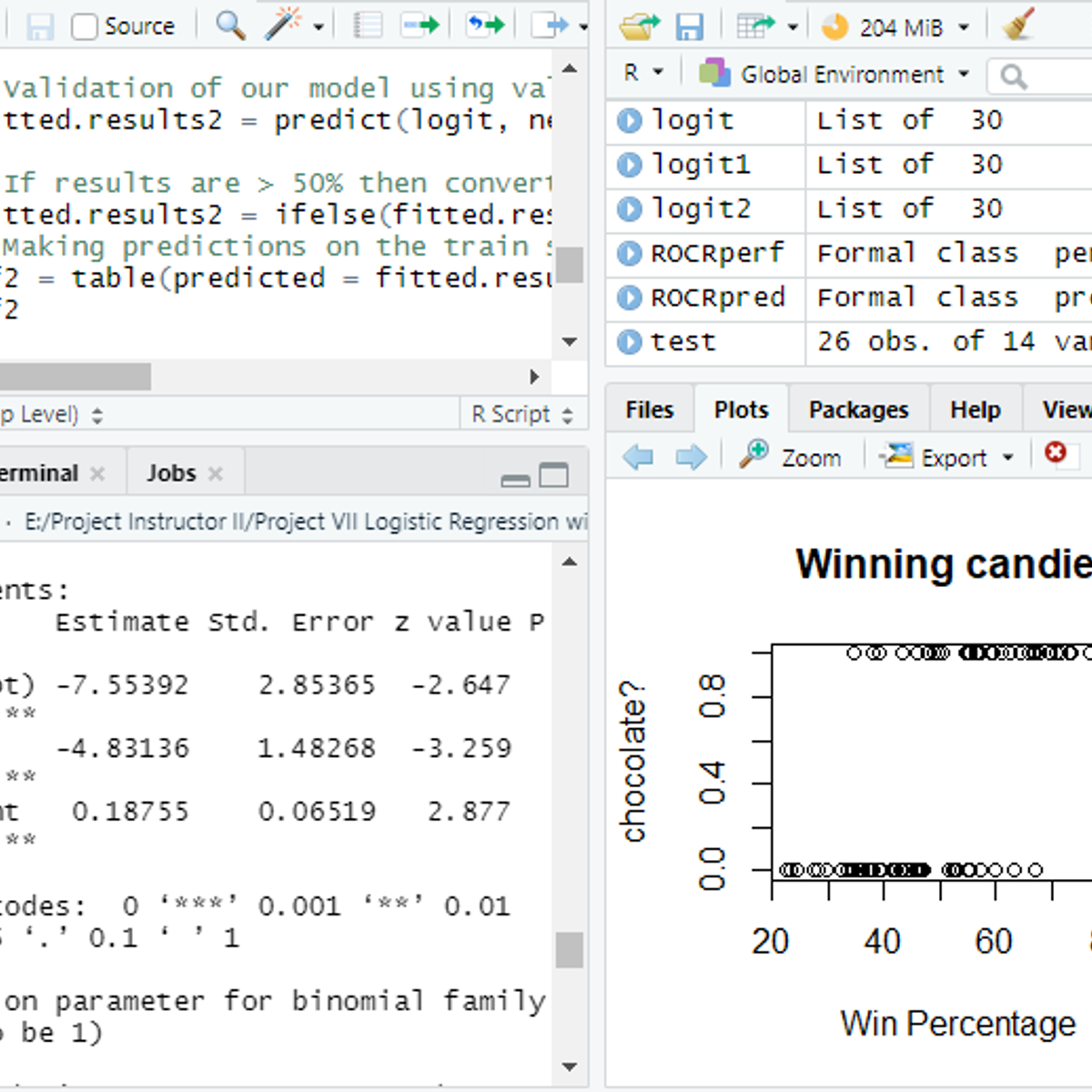

Logistic Regression&application as Classification Algorithm

In this project, you will learn about Logistic Regression and its application as Classification Algorithm. The project demonstrates the theoretical background of Logistic Regression using the Sigmoidal function. It also explains the suitability of linear vs logistic regression to answer the specific types of research questions. Finally, it covers an implementation of classification algorithm using logit model. The project utilizes the 'Candy' dataset for illustrative purpose.

Macroeconomics for Business Management

In this course, you will be introduced to some basic concepts of country-level Macroeconomics that are relevant for an integrated understanding of the macroeconomic environment in which your business (or future business) operates. In this course, the first three weeks will cover the Gross Domestic Product (GDP) and its components deeply, and the fourth week will cover inflation, monetary policy, balance of payments, and the concept of real exchange rate.

At the end of this course, you will be able to:

- Understand the concept of GDP and its importance for businesses established in a country;

- Analyze de GDP by breaking down its key components;

- Understand the importance of inflation, monetary policy, balance of payments, and real exchange rate for a country’s macroeconomic environment.

- And above it all. Understand how to make connections between those concepts and try to make good use of them when establishing your business plan or your investment decisions.

Game Theory

Popularized by movies such as "A Beautiful Mind," game theory is the mathematical modeling of strategic interaction among rational (and irrational) agents. Beyond what we call `games' in common language, such as chess, poker, soccer, etc., it includes the modeling of conflict among nations, political campaigns, competition among firms, and trading behavior in markets such as the NYSE. How could you begin to model keyword auctions, and peer to peer file-sharing networks, without accounting for the incentives of the people using them? The course will provide the basics: representing games and strategies, the extensive form (which computer scientists call game trees), Bayesian games (modeling things like auctions), repeated and stochastic games, and more. We'll include a variety of examples including classic games and a few applications.

You can find a full syllabus and description of the course here: http://web.stanford.edu/~jacksonm/GTOC-Syllabus.html

There is also an advanced follow-up course to this one, for people already familiar with game theory: https://www.coursera.org/learn/gametheory2/

You can find an introductory video here: http://web.stanford.edu/~jacksonm/Intro_Networks.mp4

Hypotheses Testing in Econometrics

In this course, you will learn why it is rational to use the parameters recovered under the Classical Linear Regression Model for hypothesis testing in uncertain contexts. You will:

– Develop your knowledge of the statistical properties of the OLS estimator as you see whether key assumptions work.

– Learn that the OLS estimator has some desirable statistical properties, which are the basis of an approach for hypothesis testing to aid rational decision making.

– Examine the concept of null hypothesis and alternative hypothesis, before exploring a statistic and a distribution under the null hypothesis, as well as a rule for deciding which hypothesis is more likely to hold true.

– Discover what happens to the decision-making framework if some assumptions of the CLRM are violated, as you explore diagnostic testing.

– Learn the steps involved to detect violations, the consequences upon the OLS estimator, and the techniques that must be adopted to address these problems.

Before starting this course, it is expected that you have an understanding of some basic statistics, including mean, variance, skewness and kurtosis. It is also recommended that you have completed and understood the previous course in this Specialisation: The Classical Linear Regression model.

By the end of this course, you will be able to:

– Explain what hypothesis testing is

– Explain why the OLS is a rational approach to hypothesis testing

– Perform hypothesis testing for single and multiple hypothesis

– Explain the idea of diagnostic testing

– Perform hypothesis testing for single and multiple hypothesis with R

– Identify and resolve problems raised by identification of parameters.

Popular Internships and Jobs by Categories

Find Jobs & Internships

Browse

© 2024 BoostGrad | All rights reserved