Back to Courses

Economics Courses - Page 10

Showing results 91-99 of 99

Business Opportunities and Risks in a Globalized Economy

This is the last of the three courses part of the Globalization, Economic Growth and Stability Specialization.¨Business Opportunities and Risks in a Globalized World¨ is the the 3rd and final course of the ¨Globalization, Economic Growth and Stability¨ Specialization taught by IE Business School's Professor Gayle Allard. This course is designed to help an investor, businessperson or economist approach macroeconomic, institutional and international data and derive information from the indicators that point to the types of opportunities and risks that they present. Students will gain practice by handling the data of some of the largest economies in the world –the United States, Japan, the European Union, China and India—and “reading the story” of their economies from their data, yielding surprisingly profound conclusions about their present and future. The course is the third in a series for the specialization but it is also a stand-alone course for anyone who wants practice in practical macroeconomics.

This course includes 4 modules, each one deep-diving into the macroeconomic circumstances that have been brought up in the recent history of four key regions: the USA, Japan, Europe, and China and India. Students will analyze the ways in which international economies relate with one another, the benefits of trade and migration and economic development and how it occurs, among other themes.

Professor Allard takes overarching macroeconomic theory and turns it into a practical tool for those interested in the opportunities and risks of investment and doing business in each of the four regions covered.

Agriculture, Economics and Nature

Sound economic thinking is crucial for farmers because they depend on good economic decision making to survive. Governments depend on economic information to make good policy decisions on behalf of the community. This course will help you to contribute to better decision making by farmers, or by agencies servicing agriculture, and it will help you to understand why farmers respond to policies and economic opportunities in the ways they do.

You can use this course to improve your skills and knowledge and to assess whether this is a subject that you'd like to study further. The course includes high-quality video lectures, interviews with experts, demonstrations of how to build economic models in spreadsheets, practice quizzes, and a range of recommended readings and optional readings. Assessment is by quizzes and a final exam.

The key economic principles that we’ll learn about can help us understand changes that have occurred in agriculture, and support improved decision making about things like agricultural production methods, agricultural input levels, resource conservation, and the balance between agricultural production and its environmental impacts.

There are literally thousands of agricultural economists around the world who work on these issues, so there is a wealth of knowledge to draw on for the course.

Watch a brief video about our course here: https://youtu.be/Y8OGswUXx48

International Business II

This course, Introduction to the Global Business Environment II, focuses on managing organizations in the international economy. Building on Introduction to the Global Business Environment I, this second course focuses on organizational level and management issues in international settings. The course prepares students with practical as well as research-based knowledge and skills necessary to successfully operating an organizational across borders. This course utilizes an inquiry based approach to understanding managing in the Global Business Environment and answering the following questions: 1. What are Foreign Currencies and how are Exchange Rates Determined? 2. How should you organize your business abroad? 3. How do you adapt your product or service for the international market? 4. What is it like to work abroad and how do you manage expatriates? 5. How to start, operate and grow a small or entrepreneurial business in the global environment? 6. What is the Current State of the Global Business Environment? This inquiry-based approach creates reflective opportunities for students to better understand managing and leading organizations in the global environment in which businesses operate. Lectures are delivered in an engaging manner which encourages reflection and inquiry. Course lectures will be delivered by the instructor in both Spanish and English.

Employment Contracts

The employment relationship is one of the foundations upon which modern society and the greater economy is built, but the nature of this relationship can be both complex and confusing. This course seeks to demystify the ways that U.S. contract law principles govern the fundamental relationship between employers and employees.

We begin by examining the default rule of at-will employment that applies to most U.S. employment relationships, and we then consider the necessary elements required to create a binding employment relationship. We also explore how courts interpret the content of employment agreements as well as what factors courts consider in awarding damages when an employment agreement is breached. Finally, we take a deeper dive into employment-related agreements such as non-disclosure agreements, non-disparagement agreements, and mandatory arbitration clauses, and how the law has evolved to keep up with the changing nature of the fundamental employment relationship.

Monetary Policy in the Asia Pacific

Watch the introduction video to the course here: https://youtu.be/U7dQzqtIFVg

The Asia-Pacific region contains some of world’s most dynamic economies. Economies around the globe rely on credible monetary policy implemented by central banking institutions. Monetary policy governs the liquidity available to the payment systems that underlie trade and finance. Smooth adjustment of liquidity can minimize instability in money and foreign exchange markets and keep inflation and growth on a secure footing. The industrial giants of China, Japan, and Korea; the Southeast Asian emerging markets of Indonesia, Malaysia, Philippines, and Thailand; and the international entrepots at Hong Kong and Singapore each face unique challenges in implementing liquidity policy.

This course is for learners with some background information on monetary policy. This advanced course will build a foundation for understanding liquidity policy implementation in the Asia-Pacific using standard economic models. The course will discuss the effects of high level discussion of a key element of national level public policy, monetary policy. Modern monetary policy connects macroeconomic conditions and key financial market indicators. It will also analyze the way that central bank goals for macroeconomic stability will determine outcomes in interest rates and exchange rates. The rigorous theoretical foundation should also build analytical skills that might be applied to policy and market analysis in a broad range of economies and even in the Asia-Pacific region as policy-making evolves in the future.

The topics covered each week:

Module 1 - Monetary Policy Implementation

Module 2 - Monetary Policy Strategy

Module 3 - Exchange Rates and Monetary Policy

After taking this course and going through the interactive activities, you will be able to:

(1) Describe Monetary Policy instruments central banks use

(2) Interpret on-going actions of central banks

(3) Apply graphical analysis and calculate basic economic measures used as tools by central banks or analysts

(4) Analyze the way that central bank goals for macroeconomic stability will determine outcomes in interest rates and exchange rates

Arctic Change & the Nexus of Governance, Economics & Culture

In this course, you will learn how the changing Arctic environment is tied to the growing economic and strategic importance of the North. After setting the stage through a review of the peoples of the Arctic and how they are dealing with change, Arctic governance, economies national defense, attention turns to marine use of the Arctic, oil and gas exploration, mining, fisheries and tourism. The course ends with a survey of recent Arctic events.

Learning Objectives: Articulate the drivers of the growing economic and strategic importance of the Arctic in the context of the environmental changes unfolding in the region, governance, and geopolitics. Identify the impacts of the changing Arctic, both positive and negative, on the peoples of the North.

Creating a Portfolio

This course integrates all the learning from the first three courses and guides the learner about ways of building a portfolio of strategies and integrating the same into a hedge fund.

In the first part of the course, you will be taught ways of measuring the contribution of a strategy to a portfolio in terms of risk and return. You will be able to appreciate the consequences of including a strategy to a new as well an existing portfolio.

Next, you are taught various ways of conducting the tilting analysis in order to determine the optimal weight to be placed on each strategy. After this you will learn to develop techniques for minimizing overall portfolio risk.

You will also get a basic overview of the regulatory framework that is applicable to hedge funds. You will know about different types of investors and the expectations of each type of investors.

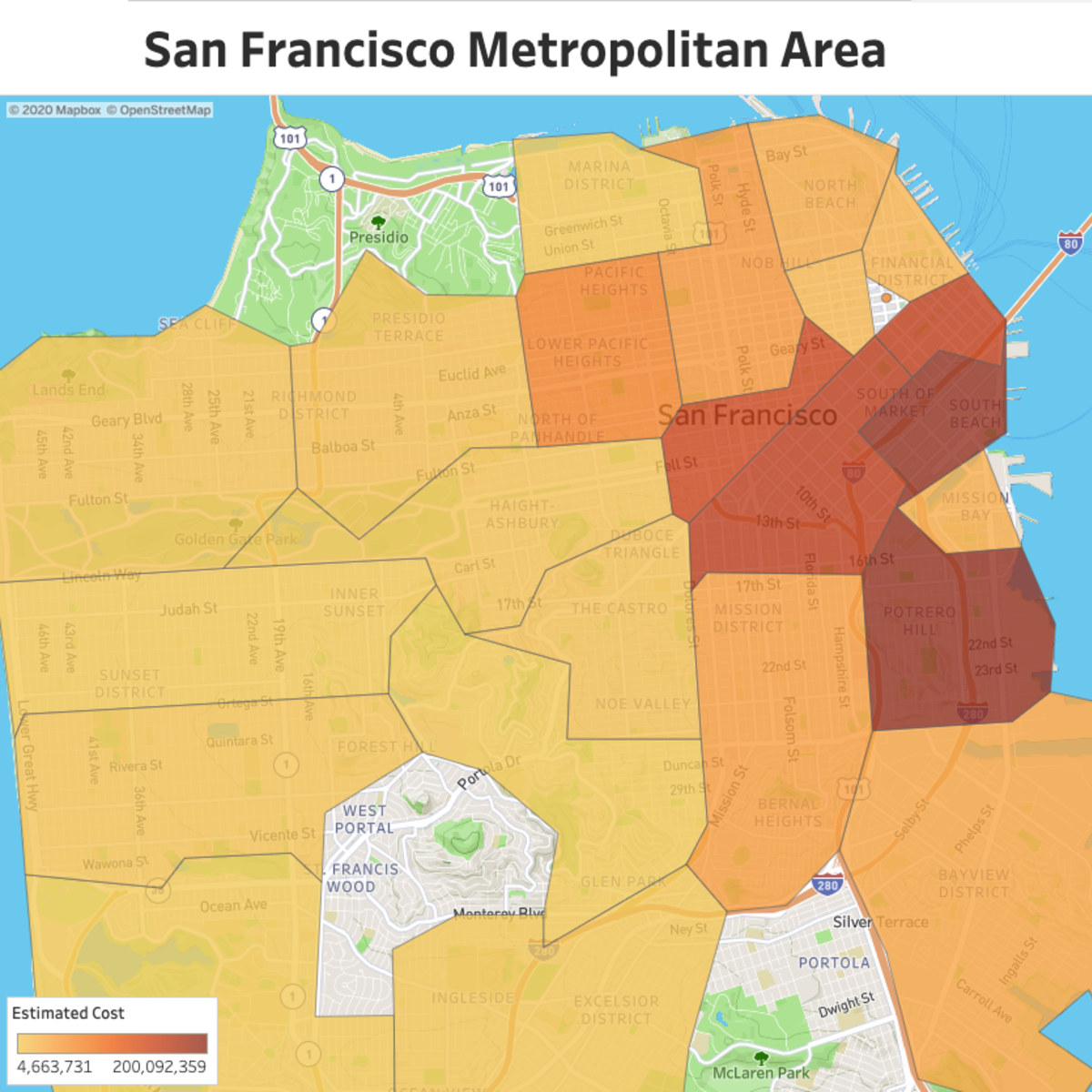

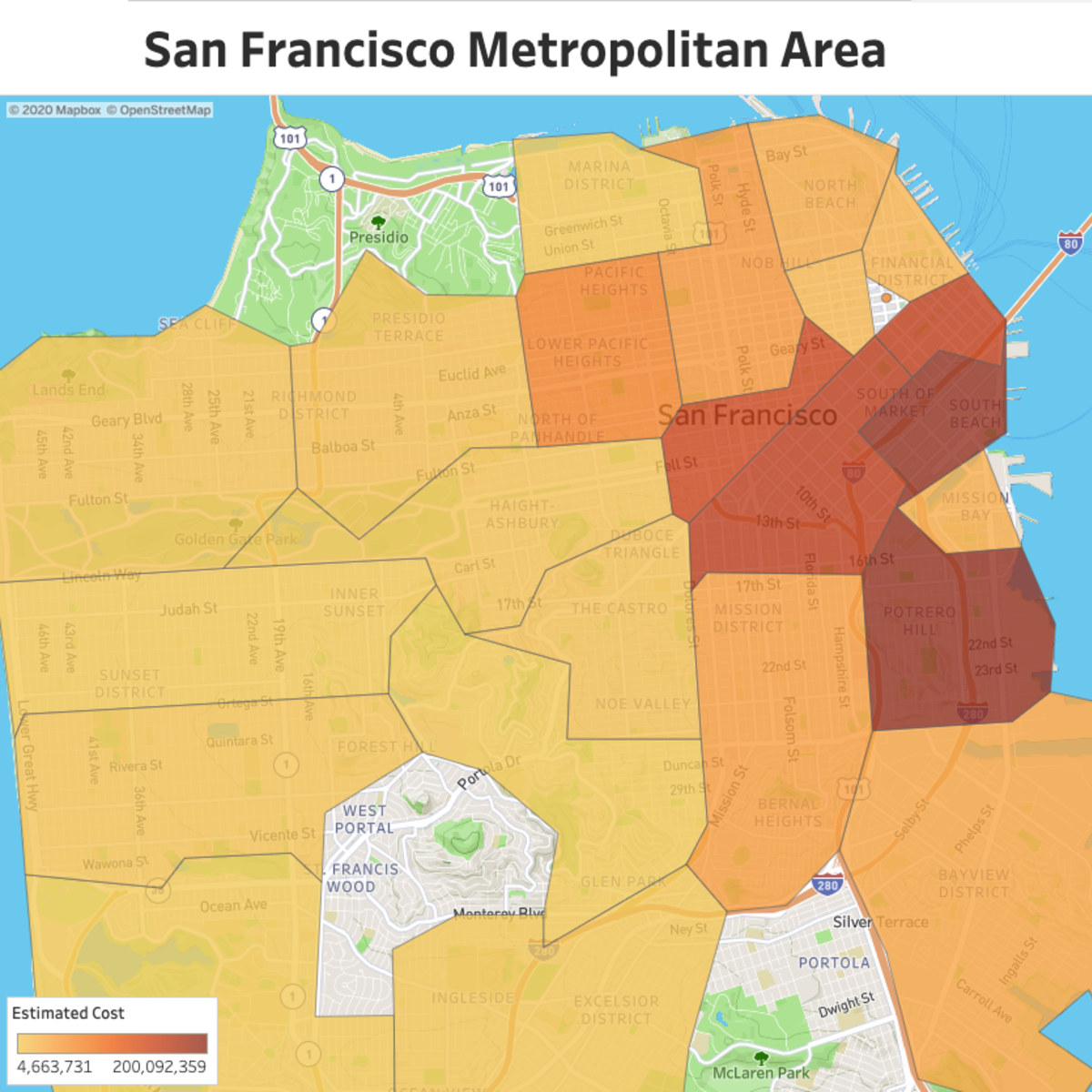

Analyze City Data Using R and Tableau

By the end of this project, you will create, clean, explore and analyze San Francisco’s building permit public data. We will use OpenStreetMap API to find the geo-coordinates of buildings using R and RStudio and we will analyze the final results in Tableau. You will learn basic data cleaning techniques using R, create a function to make requests to the OpenStreeMaps API and leverage Tableau to generate insights.

Note: This course works best for learners who are based in the North America region. We're currently working on providing the same experience in other regions.

African development – from the past to the present

African development – from the past to the present -- offers a unique economic history perspective on Africa's development. Over a period of five weeks, the course covers a logical account of historical events and decisions that have shaped the current political-economical landscape of Sub-Saharan Africa - from the pre-colonial and the colonial era, to the era of liberalisation, modern day Africa and the future prospects of the continent.

One does not need to have a dedicated historical interest to benefit from the course. The course targets a broad range of professional groups, actors, organisations and curious individuals - all sharing a common interest in improving their understanding of the limitations and opportunities inherent in the Sub-Saharan African continent.

Popular Internships and Jobs by Categories

Find Jobs & Internships

Browse

© 2024 BoostGrad | All rights reserved