Back to Courses

Economics Courses - Page 7

Showing results 61-70 of 99

Ecological and Energy Transitions in Southern Countries

The Agence Française de Développement and the Ecole normale supérieure are launching the fourth edition of the MOOC “Ecological and Energy Transitions in Southern Countries".

This edition will be launched simultaneously in 4 languages:

· In english : Ecological and Energy Transitions in Southern Countries

· In french : Transitions énergétique et écologique dans les pays du Sud

https://www.coursera.org/learn/transitions-energetiques-pays-du-sud/

· In spanish : Transiciones energéticas y ecológicas en los países del Sur

https://www.coursera.org/learn/transiciones-energeticas-y-ecologicas-en-los-paises-del-sur

. In portuguese : Transição energética e ecológica em países do sul https://www.coursera.org/learn/transiao-energtica-e-ecologica-em-paises-do-sul

This MOOC is at the junction between the development of Southern countries and sustainable development.

It has:

1) a macroeconomic and financial dimension, developed by Gael Giraud and Alain Grandjean;

2) an ecological and climatic dimension, developed by David Claessen and ENS speakers; and

3) a focus on Southern countries, developed by AFD speakers.

Here are the learning goals for the entire training program:

Goal 1: Be able to understand the relationship between the energy transition, the ecological transition, the role of energy in our economy, our economic development model, and financing issues.

Goal 2: Know how to advocate for and lobby on issues and on the need to change reality in order to implement strategies and action plans.

Goal 3: Be able to make a link between the Energy transition and financing solutions, and between comprehension and action.

No one questions the imperative need to ensure development based on personal well-being and a fair distribution of wealth.

The Challenges of a Transition for All

Until now the development of Northern countries has been based on an increasing exploitation of energy resources and a greater freedom of trade and exchange at the global scale. We now know that such a model is no longer sustainable, due to global warming and to the overexploitation of resources, which lead to health, social, and environmental disasters.

The Role of Developing Countries

With that in mind, how can we ensure fair and equitable growth for all? What role do countries from the different regions in the South have to play in this complete upheaval of the current economic, trade, and political models in order to achieve an effective energy and ecological transition?

A MOOC to Respond to these Questions

This free online training offers complementary perspectives from several specialists of issues related to climate change and the development of Southern countries. They will share their very practical understanding of the current crises and the answers that can be provided. Participants will learn from studies by:

• Researchers from the prestigious École Normale Supérieure in Paris

• Field experts from the Agence Française de Développement, a funding agency that has been committed to helping developing countries for 75 years,

• Carbone 4 founder Alain Grandjean, who will share his experience, in particular on the economic and financial aspects.

Here is the program:

1. Our development model is ecologically unsustainable

2. The dominant economic models hinder the energy and ecological transition

3. The energy transition path: decarbonizing GDP

4. The model of an ecological transition to new prosperity

5. Governance of the energy and ecological transition

6. Financing the energy and ecological transition

Economics of Money and Banking

The last three or four decades have seen a remarkable evolution in the institutions that comprise the modern monetary system. The financial crisis of 2007-2009 is a wakeup call that we need a similar evolution in the analytical apparatus and theories that we use to understand that system. Produced and sponsored by the Institute for New Economic Thinking, this course is an attempt to begin the process of new economic thinking by reviving and updating some forgotten traditions in monetary thought that have become newly relevant.

Three features of the new system are central.

Most important, the intertwining of previously separate capital markets and money markets has produced a system with new dynamics as well as new vulnerabilities. The financial crisis revealed those vulnerabilities for all to see. The result was two years of desperate innovation by central banking authorities as they tried first this, and then that, in an effort to stem the collapse.

Second, the global character of the crisis has revealed the global character of the system, which is something new in postwar history but not at all new from a longer time perspective. Central bank cooperation was key to stemming the collapse, and the details of that cooperation hint at the outlines of an emerging new international monetary order.

Third, absolutely central to the crisis was the operation of key derivative contracts, most importantly credit default swaps and foreign exchange swaps. Modern money cannot be understood separately from modern finance, nor can modern monetary theory be constructed separately from modern financial theory. That's the reason this course places dealers, in both capital markets and money markets, at the very center of the picture, as profit-seeking suppliers of market liquidity to the new system of market-based credit.

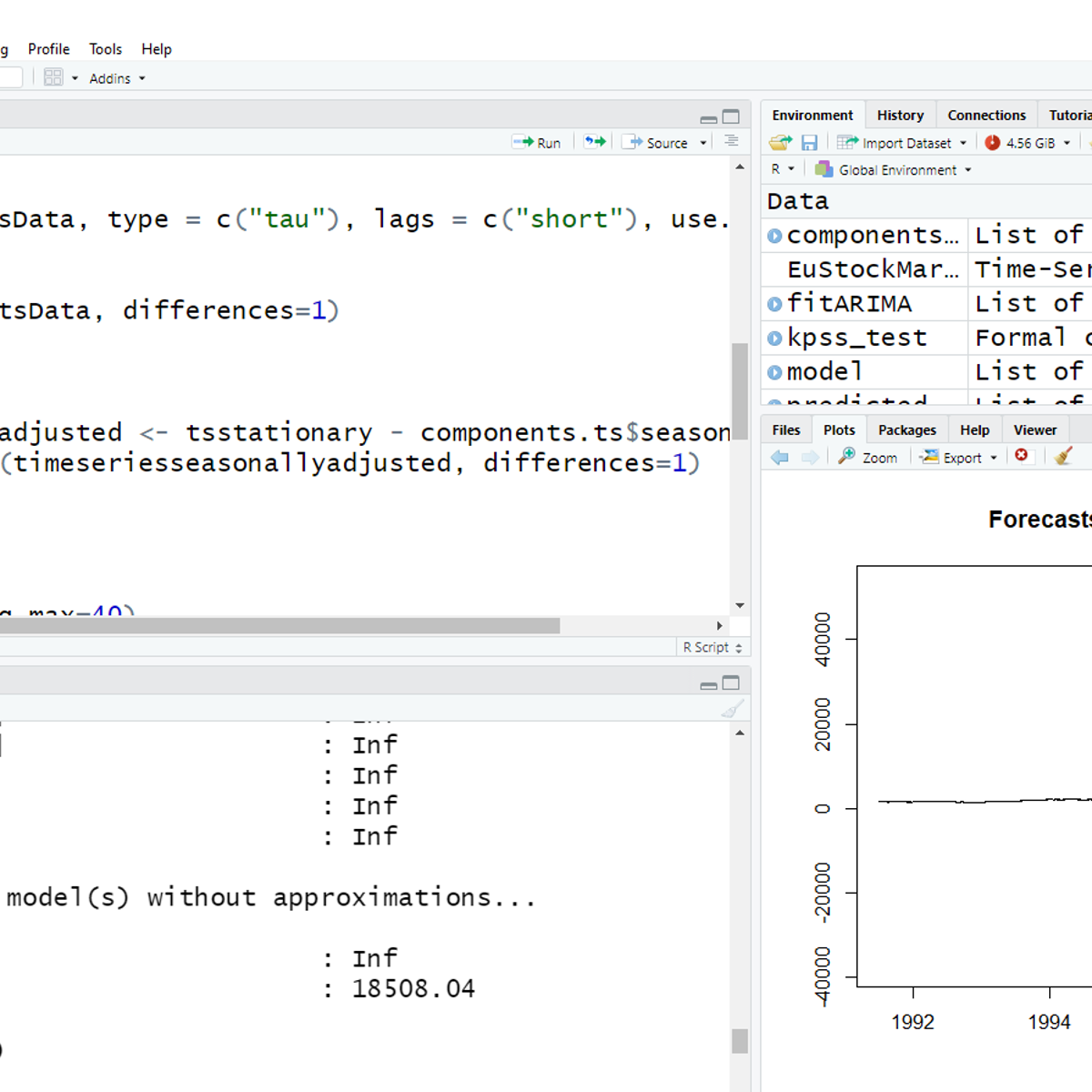

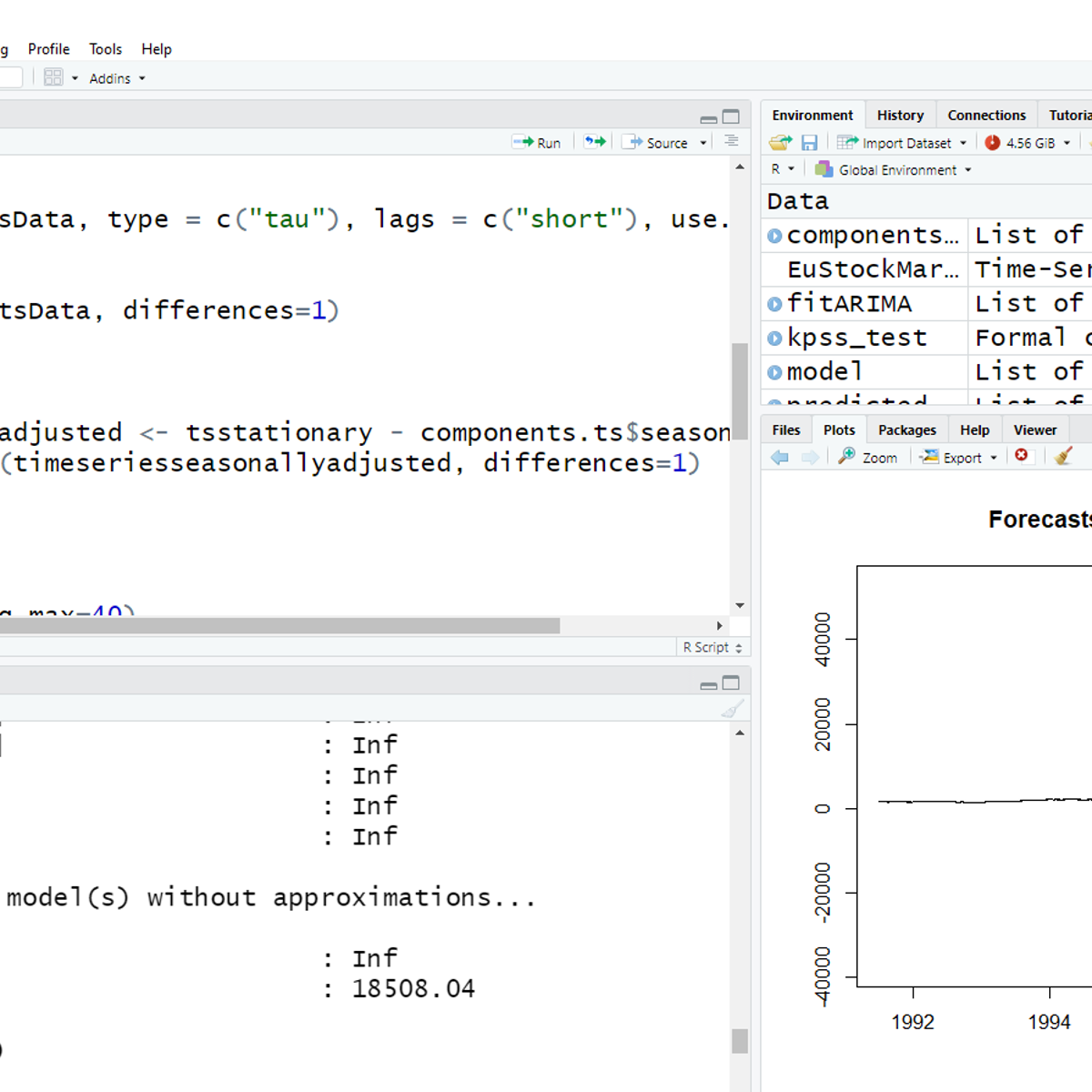

Time Series Analysis (ARIMA) with R

In this project, you will learn to conduct a thorough analysis of a time series data using ARIMA. The project explains the basic concepts of time series analysis and illustrates the same with hands-on activity on R Studio. It describes the types of time series data and its distinct components. The project covers how to conduct diagnostic tests to check for core assumptions of ARIMA, evaluating model process and orders from ACF, PACF graphs. Finally, it derives best fit model to forecast future values.

Politics and Economics of International Energy

Energy issues have always been important in international relations, but in recent years may have become even more important than in the past due to the widespread awareness of existing limits to energy sources and negative climate impacts. The course discusses global trends in energy consumption and production, various available scenarios for potential developments in the coming decades, the availability of oil reserves and the evolution of the oil industry. It then discusses natural gas and highlights the differences between oil and gas. It will also discuss renewable energy sources, nuclear energy and EU energy policy.

The course aims at providing students whose main interest is in international relations a background on energy resources, technology and economic realities to allow them to correctly interpret the political impact of current developments. It also aims at providing students, who already have a technical background in energy science or engineering, with the broad global view of energy issues that will allow them to better understand the social, economic and political impact of their technical knowledge.

ABOUT THE INSTRUCTOR :

Giacomo Luciani

Scientific Advisor for the Master in International Energy at the Paris School of International Affairs (PSIA) Sciences Po, Giacomo Luciani is also Adjunct Professor at the Graduate Institute of International and Development Studies, Geneva and Director of the Executive Master in International Oil and Gas Leadership. For the period 2010-13 he was appointed Princeton University Global Scholar, attached to the Woodrow Wilson School and the Department of Near Eastern Studies. His research focuses on the political economy of the Middle East and North Africa and on global energy issues.

RECOMMENDED BACKGROUND :

The course requires no special scientific, mathematical or economic background; all key concepts are clearly and elementarily explained. It is expected that it will be of interest to undergraduate and graduate students in schools where an equivalent course is not offered (this being the case for the vast majority of schools).

USPC

Sorbonne Paris Cité

Supported by Université Sorbonne Paris Cité

IDEX

Investissements d'Avenir

Funded by Investissements d'Avenir - 'ANR.

Info :

Course content : Licence Creative Commons BY NC SA

The Power of Markets III: Input Markets and Promoting Efficiency

The final module of the Power of Markets course begins by further exploring firm behavior in imperfectly competitive market settings: how firms with monopoly power can increase profits through price discrimination; and the price-output combinations we can expect firms to select in cases of monopolistic competition and oligopoly. We will also analyze monopolies from an efficiency perspective and look at the effects of imperfect information on firm and consumer behavior. We will next turn to exploring input markets and what determines the demand for an input by a firm, an industry, and the overall market. We will also look at the factors that affect input supply and how the supply of an input interacts with demand to determinant input prices. We will use input market theory to analyze institutions and government policies such as the NCAA sports cartel, the minimum wage, Social Security, and immigration. Finally, we will address the concept of market efficiency and what government can do to promote it as well as how government intervention may diminish it.

The Digital Marketing Revolution

The Digital Revolution is dramatically altered the way many products are created, promoted, distributed, and consumed. Before the advent of new digital technologies such as the Internet, personal computer and smartphone, marketing was largely an Analog (i.e., physical) activity. Today, many marketing activities such as how products are promoted are increasingly Digital in nature. However, we still live in an Analog (or physical) World. For example, even today, most sales are still conducted in physical stores. Thus, both marketers and consumers must simultaneously navigate both the Analog and Digital worlds on a daily basis. This course examines both the Analog and the Digital and how these two forces relate to one another within the Digital Marketing Revolution.

This course will begin with an exploration of the key differences between the Analog and the Digital and then examine four ways in which the Analog World has been affected by the Digital Revolution: Domination, Resistance, Synergy, and Transformation. This course will contain several examples of each of these concepts and explore their implications for both marketers and consumers. This course will also employ a variety of learning techniques, including video lectures, case studies, hands-on exercises, and interviews with leading marketing scholars. The learning approach will be highly interactive; you will have the opportunity to engage in a variety of hands-on activities and be a member of a rich learning community. I hope you will join us in this learning adventure.

Upon successful completion of this course, you will be able to:

-Understand the key differences between Analog and Digital and the implications of these differences for marketing.

-Understand the four ways in which the Analog is being affected by the Digital Revolution.

-Develop and apply critical thinking skills regarding the role of both the Analog and the Digital upon both firms and consumers.

-Learn several real-world examples of various strategies for successful marketing of Analog products and services in an increasingly Digital world.

This course is part of Gies College of Business’ suite of online programs, including the iMBA and iMSM. Learn more about admission into these programs and explore how your Coursera work can be leveraged if accepted into a degree program at https://degrees.giesbusiness.illinois.edu/idegrees/.

The Power of Markets II: Market Structure and Firm Behavior

In order to maximize profits, firms must ensure that any given output level is produced at least cost and then select the price-output combination that results in total revenue exceeding total cost by the greatest amount possible. With this in mind, this second module of the Power of Markets course addresses how firms can most effectively convert inputs into final output and then covers determining the best price-output combination for a firm and how this varies depending on whether the firm is operating in a perfectly competitive or imperfectly competitive market setting.

Financing for Startup Businesses

This course will teach you how to manage a startup’s financing strategy, where you will learn how to build capitalization tables (or “cap tables”) in Excel. Cap tables will help you explore different financing strategies for your startup company and determine which financing decisions are best for your entrepreneurial venture. You will also learn about innovations in the digital space that allow new ways to finance entrepreneurial ventures. These include different forms of crowdfunding, and alternative credit scoring mechanisms based on web-based data.

This course concludes with a module featuring cutting edge research from Duke University’s Fuqua School of Business on the financial technology industry. In this module, you will learn how financial technology companies are disrupting the credit

scoring industry by developing new methods for credit scoring using consumers’ digital footprints. In addition, you will explore how financial technology platforms have introduced new, experimental forms of financing, such as crowdfunding.

Trading Algorithms

This course covers two of the seven trading strategies that work in emerging markets. The seven include strategies based on momentum, momentum crashes, price reversal, persistence of earnings, quality of earnings, underlying business growth, behavioral biases and textual analysis of business reports about the company.

In the first part of the course, you will learn how to read an academic paper. What parts to pay attention to and what parts to skim through will be discussed here. For every strategy, first you will be introduced to the original research and then how to implement the strategy.

The first strategy, Piotroski F -score will be discussed in detail. You will be taught how to calculate the F - Score and how to use this score in a strategy. This is followed by the next strategy, Post earnings announcement drift (PEAD).

Introduction to Faecal Sludge Management

Do you want learn how to apply concepts of sustainable faecal sludge management (FSM) on a city-wide scale? This course starts with an overview of what faecal sludge is and an introduces you to the engineering fundamentals and required information for the design and selection of technologies. Sanitation solutions are prone to failure if an integrated planning approach that includes stakeholder involvement and the development of appropriate institutional, management and financial arrangements is not implemented. The course therefore dedicates a complete week to presenting the full picture, in addition to technology, that needs to be considered for sustainable solutions. It concludes with a focus on current research and innovations in technologies, to provide an understanding of the most up-to-date options.

This course is one of four in the series “Sanitation, Water and Solid Waste for Development".

Popular Internships and Jobs by Categories

Find Jobs & Internships

Browse

© 2024 BoostGrad | All rights reserved