Back to Courses

Finance Courses - Page 8

Showing results 71-80 of 270

Introduction to Financial Engineering and Risk Management

Introduction to Financial Engineering and Risk Management course belongs to the Financial Engineering and Risk Management Specialization and it provides a fundamental introduction to fixed income securities, derivatives and the respective pricing models. The first module gives an overview of the prerequisite concepts and rules in probability and optimization. This will prepare learners with the mathematical fundamentals for the course. The second module includes concepts around fixed income securities and their derivative instruments. We will introduce present value (PV) computation on fixed income securities in an arbitrage free setting, followed by a brief discussion on term structure of interest rates. In the third module, learners will engage with swaps and options, and price them using the 1-period Binomial Model. The final module focuses on option pricing in a multi-period setting, using the Binomial and the Black-Scholes Models. Subsequently, the multi-period Binomial Model will be illustrated using American Options, Futures, Forwards and assets with dividends.

Decentralized Finance (DeFi) Deep Dive

DeFi and the Future of Finance is a set of four courses that focus on decentralized finance. The third course is called DeFi Deep Dive. It is essential that you do the first two courses I. DeFi Infrastructure and II. DeFi Primitives before doing this course. It is the longest of the four courses and focuses on some of the leading protocols in the DeFi space. We will look at Credit and Lending (and feature MakerDAO, Compound and Aave), Decentralized Exchange with an analysis of how protocols like Uniswap and Balancer works, Derivatives (featuring Yield Protocol, dYdX and Synthetix) and Tokenization with an analysis of Set Protocol as well as wrapped bitcoin. For many of these leading protocols, we include detailed examples of how the mechanics work. For example, we show how to use a dYdX flash swap to execute an arbitrage transaction (take advantage of different prices on different exchanges for the same asset).

Getting started with Microsoft Excel

In this project, you will learn everything basic about Microsoft Excel. This program is wonderful to work with numbers, analytics, tables and create inventories. It is a program that facilitates our work to keep everything in order. You can find information about each section that we have and cover the essential tools of this program. You will be completing different tasks to understand and use the Microsoft Excel tool. Excel contains many non-visible tools that we will discuss along with this project. You can know several formula options that are available. Learn how to accommodate these forms to your liking, with visibility is perceptible and attractive. We will talk about numbers, organization, colors, and letters. We will organize the letters even in different directions to get ideas to organize the content. Excel creates calendars of organization, inventories, daily, weekly, or monthly expenses, and much more. When this program was first known, it was more for people who worked with analysis in the positions they handled. Today, many people, from students to teachers to content creators to science analytics, all use this application. For that reason, knowing this tool and all the options that you can offer to facilitate you in personal or professional life will help you continue climbing in the world.

Blockchain Transformations of Financial Services

The current global financial system is riddled with inefficiencies, uneven developments, and bizarre contradictions. Blockchain technology has the potential to bring about profound changes to financial services. In this course, you will learn how blockchain technology will disrupt the core functions of the financial services industry, offering individuals and organizations alike real choices in how they create and manage value.

Financial Management for Product Leaders

This course is for aspiring or active product leaders who wants to understand how to secure and manage funding for their activities. We will demystify key accounting and financing concepts to give product leaders a guide to developing the business case for their ideas, and securing funding to translate ideas into reality.

This course focuses on four key areas:

• Learning the fundamentals and how to create financial statements for new ventures within the corporate environment;

• Examining valuation techniques for understanding how to assess and grow the value of the corporate venture;

• Exploring the different sources of internal and external financing for the corporate venture; and

• Applying lessons learned in the course to structure a funding deal and pitch the corporate venture.

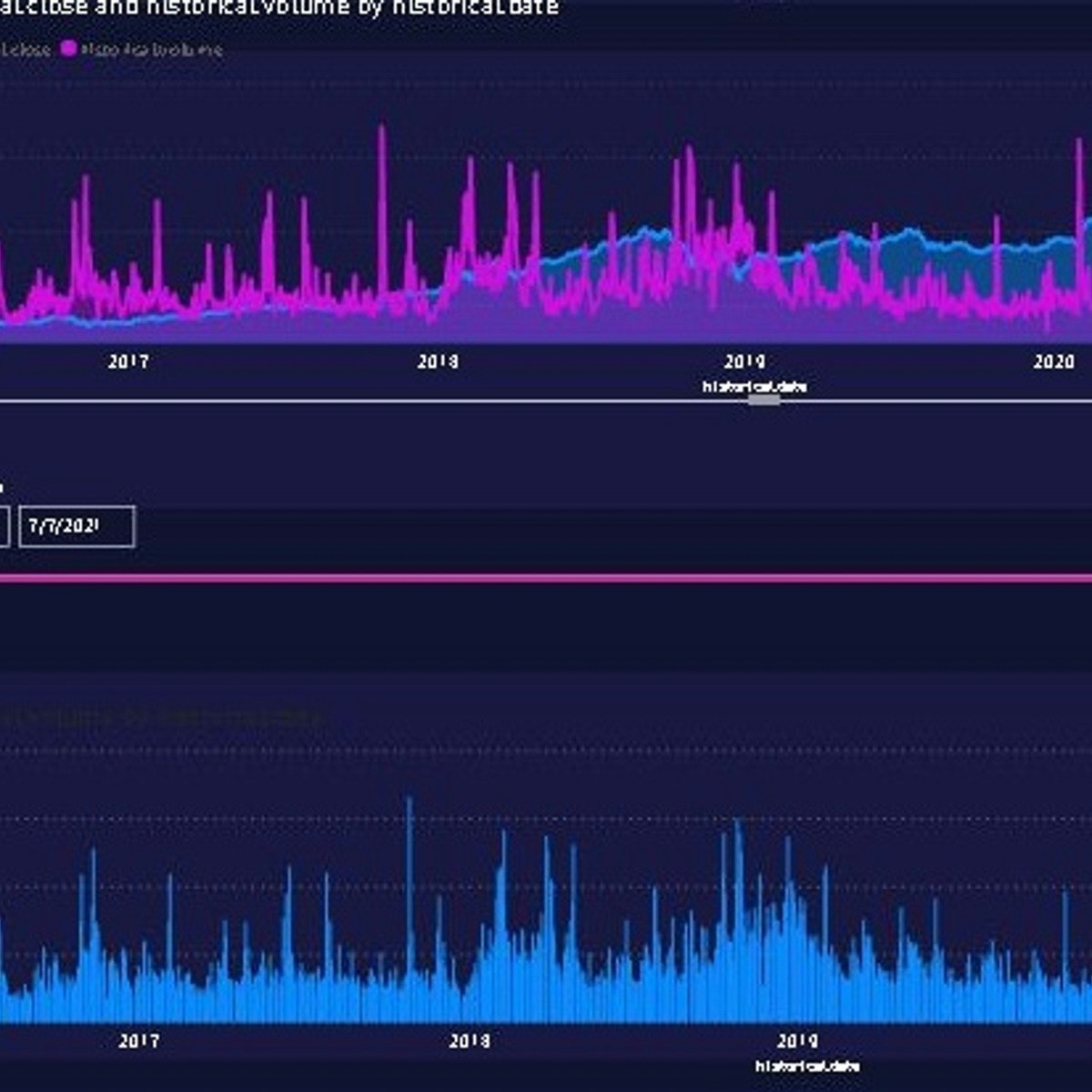

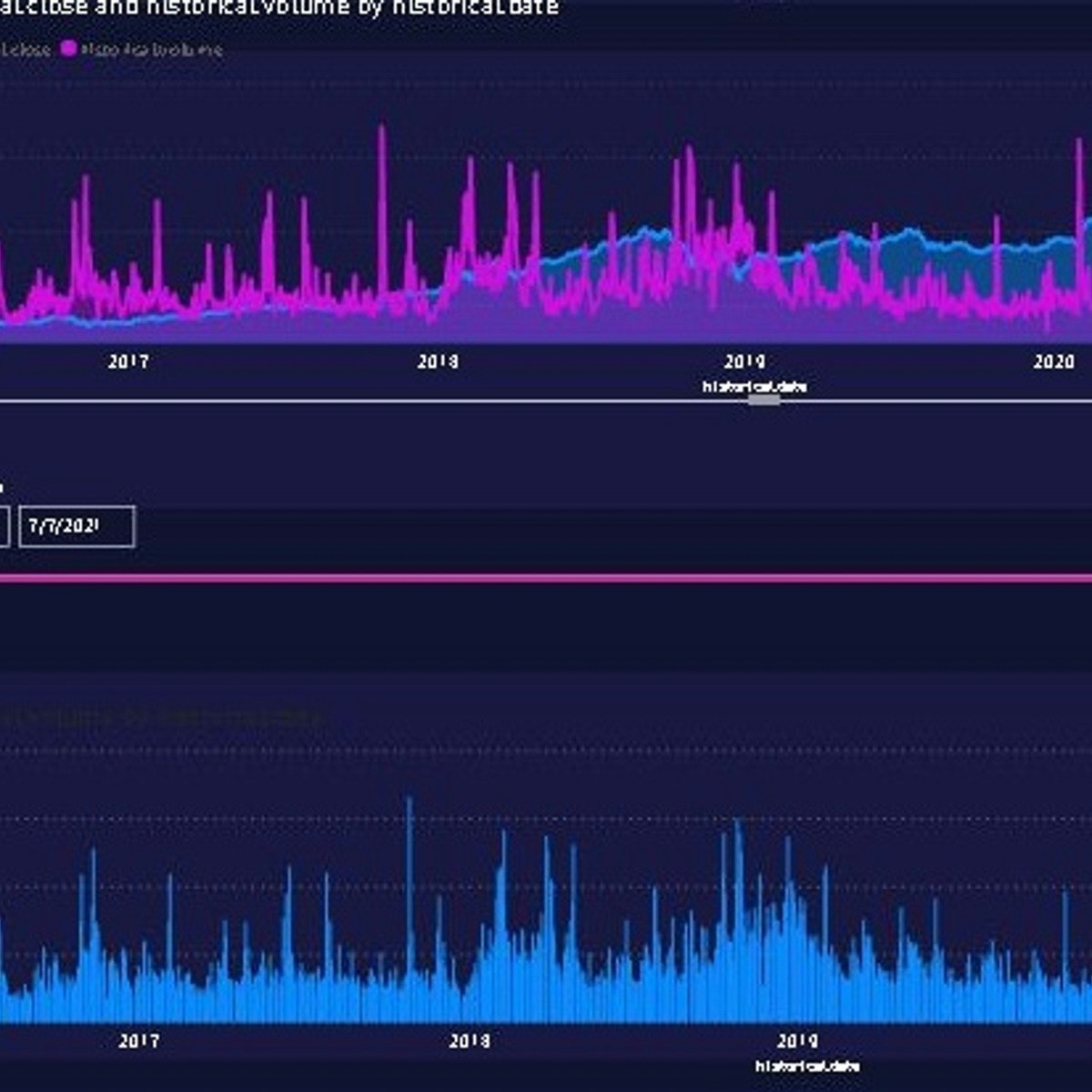

Build a Real-time Stock Market Dashboard using Power BI

In this 1 hour long project, you will build an attractive and eye-catching personal stock dashboard that is able to fetch the prices of stocks and cryptocurrencies in real-time. We will be using one of the best finance APIs to fetch real-time stock prices. We will begin by importing relevant financial data using the finance API. We will import two different data: one for stock summary and another for historical prices. We will then create our dashboard. In the final tasks, we will automate the dashboard so that you can get live prices and data for any of your favourite stocks or cryptocurrencies within a few seconds. By the end of this course, you will be confident in importing financial data using finance API, creating dashboards and live tracking of all of your favourite stocks in real-time using Power BI.

Finance for Everyone: Decisions

Finance for Everyone: Decisions will introduce you to the workings of the free markets and the foundations of finance. You will learn how free markets and their “creative destruction” provide the architecture for the global economy and how those same markets move money in ways that create and destroy wealth. Your financial toolkit will include timeless concepts like compounding, discounting, annuities, effective interest rates, and more. You will also learn how to simplify important financial calculations and apply that knowledge to real-life decisions that can influence everything from how you pay for your car to where you live. Through peer review you will publish your view on an issue important to you. You will also discover how your applied decisions connect to bigger questions relating to changing market conditions as you prepare for the second course in F4E: Markets.

Create a Budget with Google Sheets

By the end of this project, you will be able to build a basic budget using Google Sheets. You will use a template to add, delete, edit, and format a budget to meet the needs of your personal or professional goals. You will be able to read the summary tab, share the budget, and create permissions for others to access, format the charts, and use conditional formatting. You will also be able to take the Google Sheets Budget and put it into presentable files.

Note: This course works best for learners who are based in the North America region. We’re currently working on providing the same experience in other regions.

Use Power Bi for Financial Data Analysis

In this project, learners will have a guided look through Power Bi dynamic reports and visualizations for financial data analysis. As you view, load, and transform your data in Power Bi, you will learn which steps are key to making an effective financial report dashboard and how to connect your report for dynamic visualizations. Data reporting and visualization is the most critical step in a financial, business, or data analyst’s functions. The data is only as effective if it can be communicated effectively to key stakeholders in the organization. Effective communication of data starts here.

Country Level Economics: Policies, Institutions, and Macroeconomic Performance

This course examines macroeconomic performance in the short and long run based on the economy’s institutional and policy environment. First, we will develop a model of macroeconomy in the short run when the price level has its own momentum and does not respond much to supply and demand forces. Then, we’ll begin analyzing the long-run equilibrium by examining the foreign exchange market. The third module examines the drivers of aggregate output in the long run and the mechanisms of adjustment from the short run to the long run. Finally, we will discuss the characteristics of desirable macroeconomic policies and the reasons why actual policies deviate from them.

You will be able to:

• Understand how the market for aggregate goods and services interacts with the money market to shape the macroeconomic equilibrium which determines income, interest rate, and exchange rate in the short run

• Assess the dynamic effects of macroeconomic policies and understand the roles of globalization, government policies, institutions, and expectations in macroeconomic outcomes

This course is part of Gies College of Business’ suite of online programs, including the iMBA and iMSM. Learn more about admission into these programs and explore how your Coursera work can be leveraged if accepted into a degree program at https://degrees.giesbusiness.illinois.edu/idegrees/.

Popular Internships and Jobs by Categories

Find Jobs & Internships

Browse

© 2024 BoostGrad | All rights reserved