Back to Courses

Finance Courses - Page 11

Showing results 101-110 of 270

Getting Started with ProfitBooks

This project will give you the opportunity to familiarize yourself with the cloud-based platform, ProfitBooks. We will start this project by introducing you to the platform through creating an online account and taking a virtual tour of the software. This step will include updating your company profile in the settings. We will continue our introduction by building out a CRM through the customer profile feature. Once the customer profiles are created, you will be introduced to some beginner features on the platform.

This project will focus on the Item feature for products and services & invoice feature for billing. Upon completion of this project, you will understand how to add customers to your CRM, inventory items and services, and invoice customers. You will have the confidence to continue towards intermediate use of ProfitBooks in a continuation series.

ProfitBooks is an online accounting and payroll management software for small businesses. It allows users to organize offices finances and track all activities related to their business. This free online tool allows you to manage your money without accounting knowledge, grow sales with powerful invoicing tools, track inventory with ease, and run your business with total confidence.

ProfitBooks hosts your information on the secure and widely-trusted Amazon Web Services (AWS) while implementing additional security features like secure-access, built-in firewalls, encrypted data storage and periodic back-ups. You can read more about their security policy here: https://www.profitbooks.net/cloud-data-security/.

Create a Simple Project Timeline in Google Sheets

By the end of this project, you will be able to create a simple Project Timeline using Google Sheets. You will have a better understanding of how to use this tool to help track and present project schedules.

Note: This course works best for learners who are based in the North America region. We’re currently working on providing the same experience in other regions.

Behavioral Finance

We make thousands of decisions every day. Do I cross the road now, or wait for the oncoming truck to pass? Should I eat fries or a salad for lunch? How much should I tip the cab driver? We usually make these decisions with almost no thought, using what psychologists call “heuristics” – rules of thumb that enable us to navigate our lives. Without these mental shortcuts, we would be paralyzed by the multitude of daily choices. But in certain circumstances, these shortcuts lead to predictable errors – predictable, that is, if we know what to watch out for. Did you know, for example, that we are naturally biased towards selling investments that are doing well for us, but holding on to those that are doing poorly? Or that we often select sub-optimal insurance payment plans, and routinely purchase insurance that we don’t even need? And why do so many of us fail to enroll in our employer’s corporate retirement plans, even when the employer offers to match our contributions?

Behavioral finance is the study of these and dozens of other financial decision-making errors that can be avoided, if we are familiar with the biases that cause them. In this course, we examine these predictable errors, and discover where we are most susceptible to them. This course is intended to guide participants towards better financial choices. Learn how to improve your spending, saving, and investing decisions for the future.

Financial Planning for Young Adults

Financial Planning for Young Adults (FPYA), developed in partnership with the CFP Board, is designed to provide an introduction to basic financial planning concepts for young adults. The FPYA course is organized across eight separate modules within a 4-week window. Topics covered include financial goal setting, saving and investing, budgeting, financial risk, borrowing and credit. Because financial planning is such a personal topic, you will be encouraged to define your own financial goals and objectives while we discuss concepts and provide tools which can be applied in helping you reach those goals.

Within each module, you will view a combination of traditional lecture style videos along with video vignettes that introduce financial topics for discussion among participants. The video vignettes provide a unique and exciting component to this course. Each vignette introduces a real-world scenario where financial decisions must be made and financial planning concepts can be applied. You will be challenged to think critically about each scenario and decide how you might come to a resolution if ever faced with a similar situation.

Finally, the course also includes material throughout which is focused on career opportunities in financial planning, including video interviews with actual CFP® professionals and other professionals working in this exciting and growing career area. The final module in the class is devoted to the topic of financial planning as a career.

More Introduction to Financial Accounting

The course builds on my Introduction to Financial Accounting course, which you should complete first. In this course, you will learn how to read, understand, and analyze most of the information provided by companies in their financial statements. These skills will help you make more informed decisions using financial information.

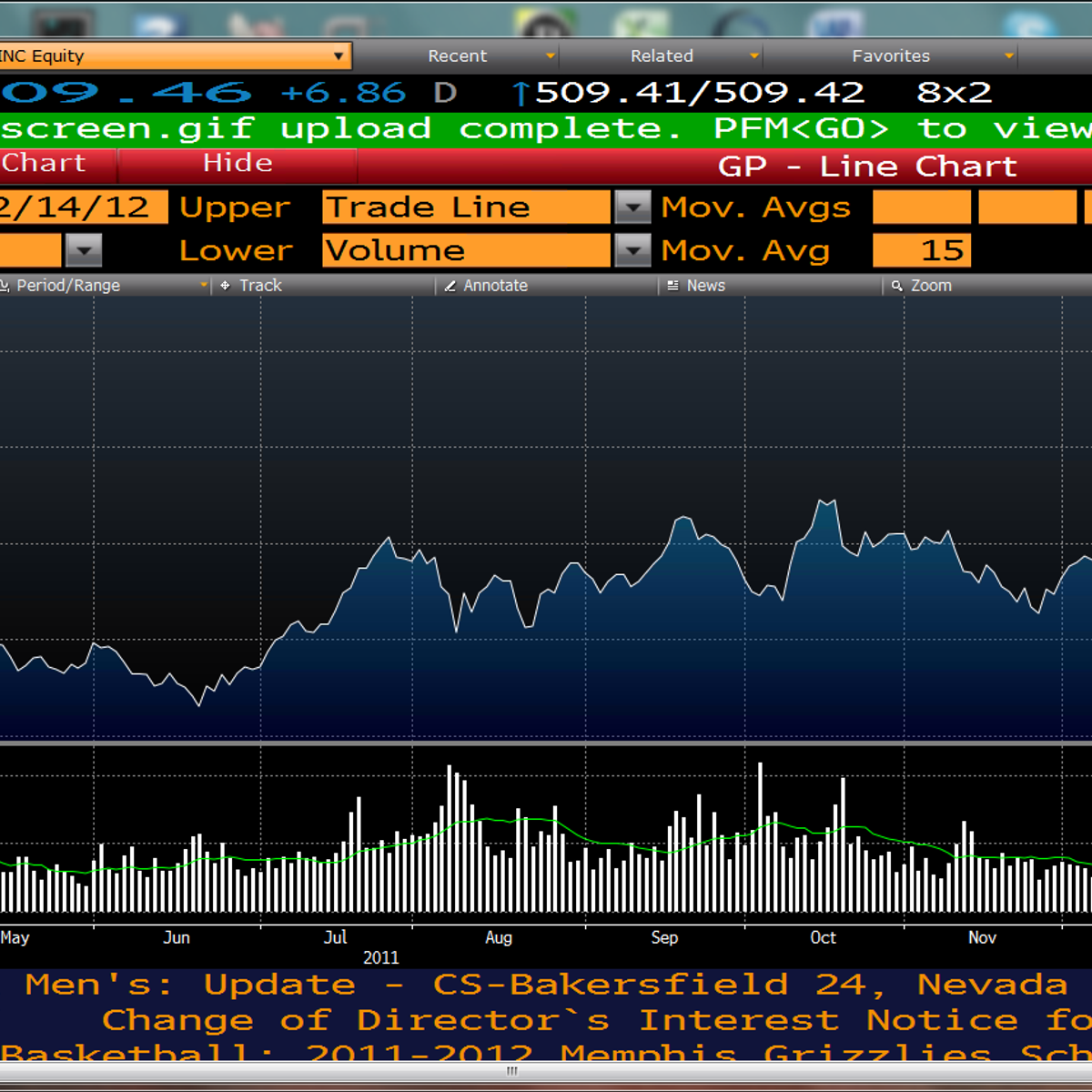

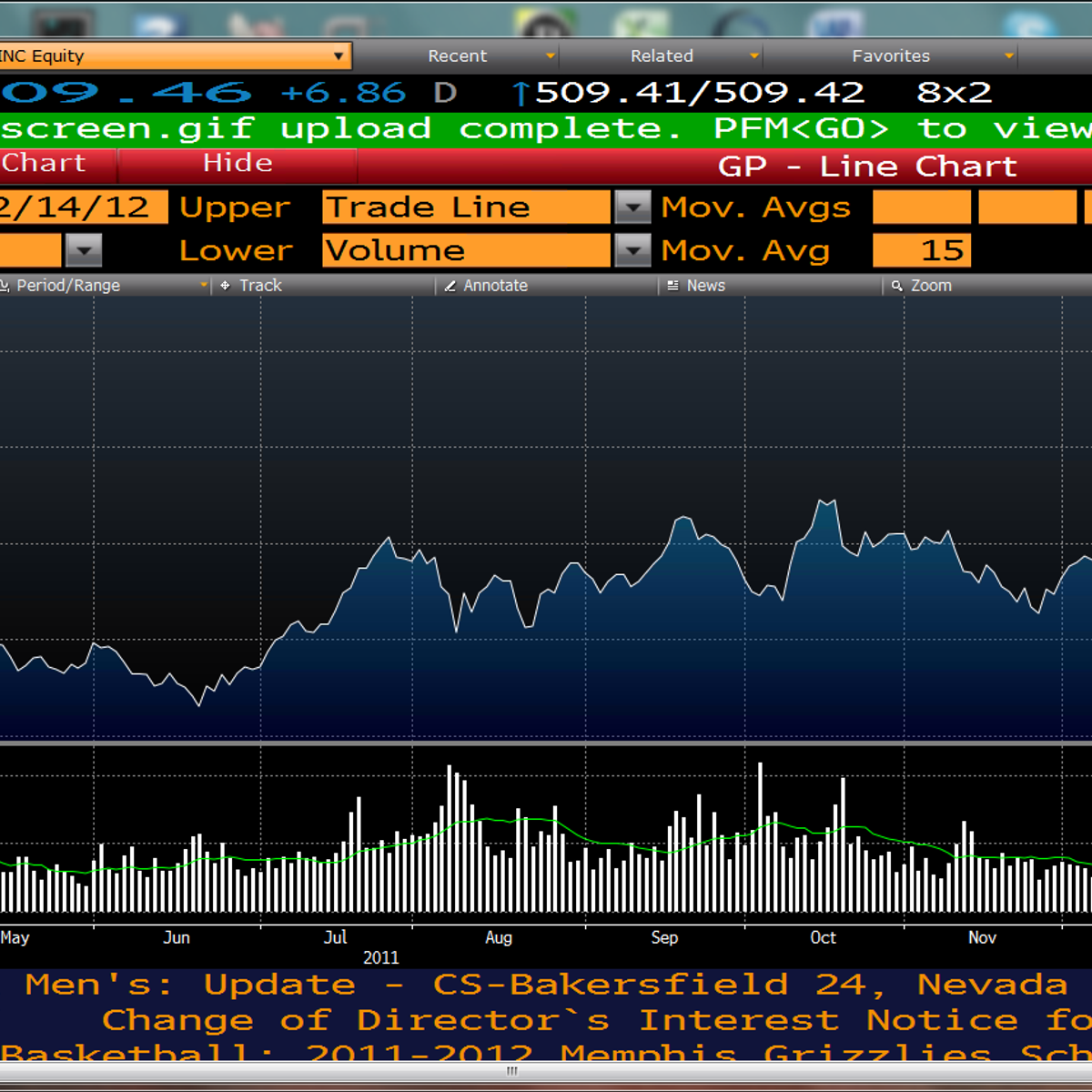

Analyze Apple's Stock and Financials with Bloomberg Terminal

In this 1-hour long guided tutorial, you will learn how to use Bloomberg to access equities and financials data, analyze and interpret stock and financial data, use Bloomberg DES, GP, ANR, FA, MODL, and EQRV functions.

Note: This tutorial works best for learners who are based in the North America region. We're currently working on providing the same experience in other regions.

This tutorial requires access to Bloomberg Terminal.

This tutorial’s content is not intended to be investment advice and does not constitute an offer to perform any operations in the regulated or unregulated financial market.

Income Features in ProfitBooks

By the end of this project you will be able to use ProfitBooks to manage your small business’ income. You will learn about sales orders, invoices, services, and estimates. You will be able to take a sales order from beginning to end in the system, as well as reconcile invoices attached to sales orders. As you continue through the project you will learn how to manage inventory, add services, and create estimates for customers. You will gain the fundamentals to manage income using ProfitBooks.

ProfitBooks hosts your information on the secure and widely-trusted Amazon Web Services (AWS). The company has also implemented additional security features like secure-access, built-in firewalls, encrypted data storage and periodic back-ups to keep your data safe. You can read more about their security policy here: https://www.profitbooks.net/cloud-data-security/

Macroeconomic Financial Accounts

This course is primarily aimed at undergraduates attending their final year or University students in monetary and financial economics, international macroeconomics and data mining. Professionals in Government institutions, Central Banks, business and the financial industry, along with other professionals interested in finance and macroeconomics, may also benefit from this course. The lectures, the tutorials and the activities lead the participants, step-by-step, through the system of financial accounts and provide unique hands-on guides to the macroeconomic databanks of the major national and international institutions (OECD, European Central Bank, US Federal Reserve System, Bank for International Settlements, IMF). At the end of the course students will gain a clear overview of the financial connections among the institutional sectors in market economies. Student activities include manipulations of data obtained from institutional websites with spreadsheets in order to construct tables and graphs.

The Global Financial Crisis

Former U.S. Secretary of the Treasury Timothy F. Geithner and Professor Andrew Metrick survey the causes, events, policy responses, and aftermath of the recent global financial crisis.

Create Charts and Graphs in Visme

By the end of this project, you will have learned how to create a sales presentation with a variety of graphs and charts using the free version of Visme.

Visme is a web-based graphic design platform that allows users to create professional visual content for both private and business purposes.

You will learn to use Visme to create visually appealing presentations for marketing and business purposes. We can use Visme to complete this project because it provides all the tools you need to create simple and complex charts while working as an individual or team.

Popular Internships and Jobs by Categories

Find Jobs & Internships

Browse

© 2024 BoostGrad | All rights reserved