Back to Courses

Economics Courses - Page 5

Showing results 41-50 of 99

Population Health: Alternative Payment Models

The way we currently pay our care providers lead to suboptimal outcomes and unnecessary spending. Consequently, we fail to maximize the value of our health care services. We need to change provider payment models in order to keep health care systems financial sustainability. Doing nothing is not an option. But the question is, how do we do it?

During this course, we will discuss the rationale for payment reforms and dive into the key design elements of Alternative Payment Models (APMs) and how they change care provider incentives. You will learn about a roadmap to design and implement APMs on your own. You will learn about behavioural economics and human behaviour which are essential to advance the design and implementation of APMs. After the course you can apply your sharpened skills to lead change in health care via innovative payment models in order to increase value of health care services.

This course is targeted at a variety of professionals in the healthcare sector in order to realise a common language. Are you a provider, board member, working at a public or private payer or researcher working in the health sector, this course is relevant for you!

This Course is part of the to-be-developed Leiden University master program Population Health Management. If you wish to find out more about this program see the last reading of this Course!

Optimization Methods in Asset Management

This course focuses on applications of optimization methods in portfolio construction and risk management. The first module discusses portfolio construction via Mean-Variance Analysis and Capital Asset Pricing Model (CAPM) in an arbitrage-free setting. Next, it demonstrates the application of the security market line and sharpe optimal portfolio in the exercises. The second module involves the difficulties in implementing Mean-Variance techniques in a real-world setting and the potential methods to deal with it. We will introduce Value at Risk (VaR) and Conditional Value at Risk (CVaR) as risk measurements, and Exchange Traded Funds (ETFs), which play an important role in trading and asset management. Typical statistical biases, pitfalls, and their underlying reasons are also discussed, in order to achieve better results when completing real statistical estimation. The final module looks directly at real-world transaction costs modeling. It includes the basic market micro-structures including order book, bid-ask spread, measurement of liquidity, and their effects on transaction costs. Then we enrich Mean-Variance portfolio strategies by considering transaction costs.

Digital Business - Understand the digital world

Facebook, AirBnB, Tesla, Amazon, Uber. In just a few years, companies like these have changed the face of the global economy. Meanwhile, hundreds of thousands of start-ups are disrupting old business models, taking on centennial industrial groups – and winning. It’s clear that the rules of business have changed forever.

This MOOC provides a knowledge toolkit for the ongoing digital revolution. You’ll discover 10 concepts that are essential for understanding the new mechanisms of digital business and innovation.

Each concept is explained in its own beautifully designed, content-rich instructional video, along with additional resources for you to explore. The ideas are illustrated with up-to-the-minute case studies and examples from a wide range of industries.

Week 1 : Why Digital Changes Everything

Week 2 : Creating Value in a Digital World

Week 3 : Thinking and Acting Differently

This MOOC is ideal for learners from a wide range of backgrounds. It is brought to you by three expert professors and researchers from IMT - Telecom Paris, a leading European graduate school in the field of digital technology and social science.

This MOOC is supported by the Patrick and Lina Drahi Foundation.

The Econometrics of Time Series Data

In this course, you will look at models and approaches that are designed to deal with challenges raised by time series data. The discussion covers the motivation for the use of particular models and the description of the characteristics of time series data, with a special attention raised to the potential memory. You will:

– Discuss time series models, that refer to data that have been collected over a period on one or more variables for the same individual.

– Explore both on stationary and non-stationary time series models, as well as the difference between the non-stationary data and the trend-stationary processes

– Consider the problems that may occur with non-stationarity data.

– Discover the applications of time series models that are of use when we want to model the GDP growth of an economy, and to test for the Purchasing Power Parity Hypothesis.

– Explore the idea of forecasting using econometric models.

– Discuss different criteria to decide how good your in-sample and out-of-sample forecasts are.

– Explore the problem raised by data where the variance is non-constant, and models for volatility forecasting.

– Estimate ARCH(p) and GARCH(p,q) models for volatility with real financial market data and present how to extend these models to the mean of the time series via Garch-in-mean.

It is recommended that you have completed and understood the previous three courses in this Specialisation: The Classical Linear Regression Model, Hypothesis Testing in Econometrics and Topics in Applied Econometrics.

By the end of this course, you will be able to:

– Manipulate and plot the different types of data

– Estimate and interpret the empirical autocorrelation function

– Estimate and compare models for stationary series

– Test for non-stationarity of time series data

– Estimate and interpret cointegration equations

– Perform in-sample and out-of-sample forecasting exercises

– Estimate and compare models for changing volatility

Marketing in a Digital World

This course examines how new digital tools, such as the Internet, smartphones, and 3D printing, are revolutionizing the world of marketing by changing the roles and practices of both firms and consumers. Marketing in a Digital World is one of the most popular courses on Coursera with over 500,000 learners and is rated by Class Central as one of the Top 50 MOOCs of All Time (https://www.class-central.com/report/top-moocs/).

You will be able to:

• Understand how digital tools are changing the nature of marketing

• Explain how digital tools allow consumers to take a more active role in product development, promotion, placement, and pricing activities

• Obtain a new set of concepts, tools, and stories to enhance your digital marketing efforts

This course is part of Gies College of Business’ suite of online programs, including the iMBA and iMSM. Learn more about admission into these programs and explore how your Coursera work can be leveraged if accepted into a degree program at https://degrees.giesbusiness.illinois.edu/idegrees/.

Trading Basics

The purpose of this course is to equip you with the knowledge required to comprehend the financial statements of a company and understand the various transactions that take place in the stock market so that you can replicate the strategies discovered by the extant academic literature.

The first part of the course provides a brief introduction to financial statements and various common filings of firms. You will learn how to obtain information regarding a company's performance from them and use the information to build trading strategies. Next, you are taught basic asset pricing theories so that you will be able to calculate the expected returns of a stock or a portfolio. Finally, you will be introduced to the actual functioning of asset markets, type of players in the market, different types of orders and the efficient ways and opportune time to execute them, trading costs and ways of minimizing them, the concept of liquidity .etc. This knowledge is required to develop efficient algorithm to execute various trading strategies.

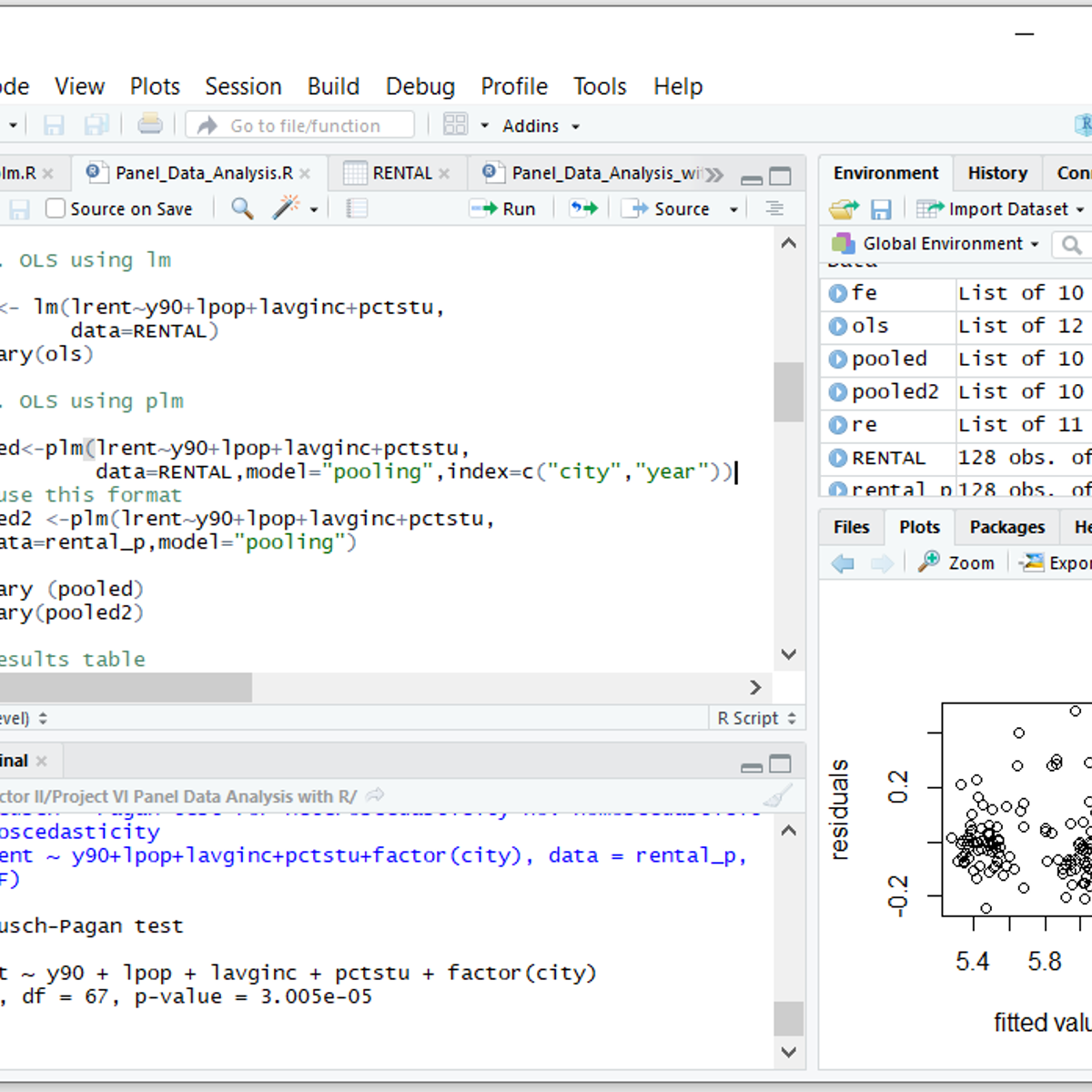

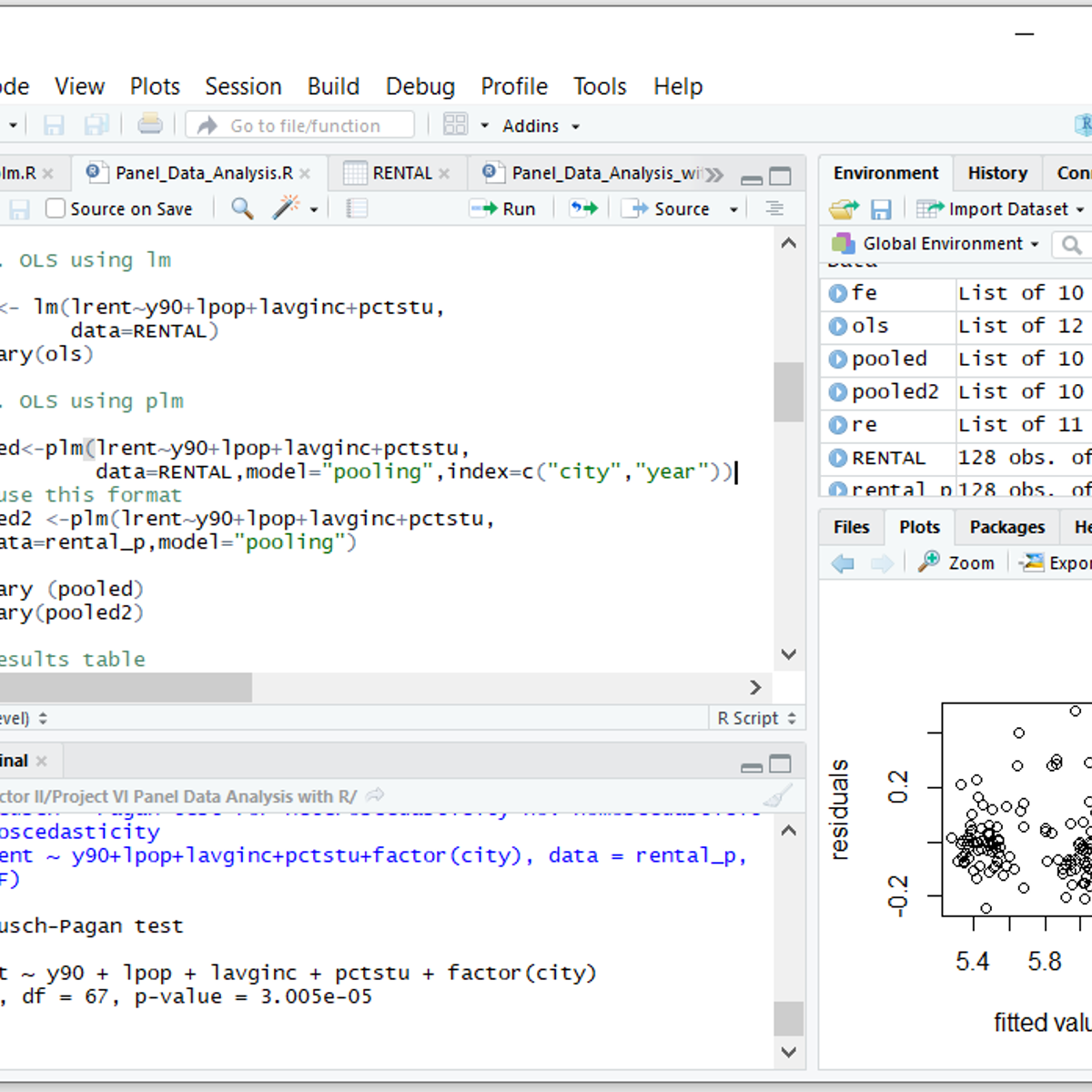

Panel Data Analysis with R

In this 1-hour long project-based course, you will learn how to conduct Panel Data (Regression) Analysis. You will receive step-by-step instructions to analyze the 'RENTAL' dataset from 'Introductory Econometrics: A Modern Approach' by Wooldridge using R Studio. In this project, we will discuss three models namely, Ordinary Least Square (OLS), Fixed effects (FE) and Random effects (RE) in brief and check which one fits the model best. You will also learn some additional diagnostic tests which were not required for this example but are useful for other panel datasets (especially, macro panels).

Note: This course works best for learners who are based in the North America region. We’re currently working on providing the same experience in other regions.

Game Theory II: Advanced Applications

Popularized by movies such as "A Beautiful Mind", game theory is the mathematical modeling of strategic interaction among rational (and irrational) agents. Over four weeks of lectures, this advanced course considers how to design interactions between agents in order to achieve good social outcomes. Three main topics are covered: social choice theory (i.e., collective decision making and voting systems), mechanism design, and auctions.

In the first week we consider the problem of aggregating different agents' preferences, discussing voting rules and the challenges faced in collective decision making. We present some of the most important theoretical results in the area: notably, Arrow's Theorem, which proves that there is no "perfect" voting system, and also the Gibbard-Satterthwaite and Muller-Satterthwaite Theorems. We move on to consider the problem of making collective decisions when agents are self interested and can strategically misreport their preferences. We explain "mechanism design" -- a broad framework for designing interactions between self-interested agents -- and give some key theoretical results. Our third week focuses on the problem of designing mechanisms to maximize aggregate happiness across agents, and presents the powerful family of Vickrey-Clarke-Groves mechanisms. The course wraps up with a fourth week that considers the problem of allocating scarce resources among self-interested agents, and that provides an introduction to auction theory.

You can find a full syllabus and description of the course here: http://web.stanford.edu/~jacksonm/GTOC-II-Syllabus.html

There is also a predecessor course to this one, for those who want to learn or remind themselves of the basic concepts of game theory: https://www.coursera.org/learn/game-theory-1

An intro video can be found here: http://web.stanford.edu/~jacksonm/Game-Theory-2-Intro.mp4

Property and Liability: An Introduction to Law and Economics

Think about the oldest and most familiar principles of American law, property and proportional liability, in a new and surprising way, and learn to apply economic reasoning to an especially important and interesting aspect of life.

International Business I

We live in a world of intensifying global relationships, one in which international business has become the key determinant of economic development and prosperity. This course, Global Business Environment, Part I, introduces students to a fundamental understanding of the socioeconomic political, cultural, and linguistic environment in which international businesses operate. This course utilizes an inquiry-based approach to understanding country level relationships in the Global Business Environment. It surveys the global business environment by asking and answering key questions about society, the global economy, cultures, institutions and languages. The questions we will ask are: 1. What is Globalization?, 2. Is Globalization New?, 3. How do Political and Social Institutions impact National Economic Development?, 4. What is the role of Culture?, 5. What are the Gains from Trade?6. Free Trade, Free-r Trade or Managed Trade?, 7. What are Foreign Currencies and how are Exchange Rates Determined?, 8. What does the Current Global Business Environment look like? This inquiry-based approach creates reflective opportunities for students to better understand the environment in which businesses operate. Lectures are delivered in an engaging manner, which encourages reflection and inquiry.

Popular Internships and Jobs by Categories

Find Jobs & Internships

Browse

© 2024 BoostGrad | All rights reserved